Venture capital trust Octopus Investments has opened a £120 million fundraising for its flagship Titan fund, which will be used to help early-stage businesses with high growth characteristics grow to an eventual exit or stock market flotation.

The fund, will be open for a year (but may close earlier if fully subscribed), will invest in early-stage tech businesses and will aim to pay regular tax-free dividends of a minimum of 5p per share annually.

What is the Octopus Titan Fund?

Over the years, Titan, a team of 16 managed by Jo Oliver, has backed around 50 early-stage companies including property firm Zoopla – the first VCT backed ‘unicorn’ as well as software firm SwiftKey, Tails.com and food company Graze. It made 33 times its money on Zoopla but a quarter of the businesses it backs fail, Mr Oliver said in an interview with the Daily Telegraph earlier this year.

How do VCTs work?

VCTs cannot invest more than £15 million in each investment and 70 per cent of investments must be distributed to qualifying investments within three years, due to regulations. Also, 30 per cent of funds may be allocated to gilts, government securities or blue-chip shares. The trusts are also limited to 15 per cent in a single holding.

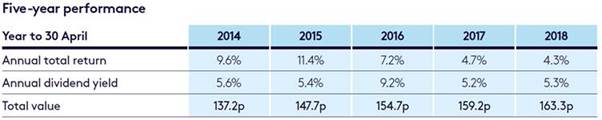

Titan’s total return record so far

The minimum investment is £3,000 while the maximum investment qualifying for tax relief is £200,000.

The fundraise follows last year’s record-breaker when Titan raised £200 million.

In the 2017/18 tax year, total VCT fundraising raised £725 million – the second highest amount since 1995, according to the Association of Investment Companies.

Further reading on VCTs

- Here’s how businesses are capitalising on the growth of the dog market in the UK

- VCTs and EIS remain popular and valuable for businesses and investors

What tax relief can you get with VCTs?

VCTs offer investors up to 30 per cent upfront income tax relief if shares held in the VCT are held for at least five years as well as tax-free dividends and growth.

Octopus is the only VCT provider to offer an ISA wrapper on a VCT which enables investors to transfer any existing ISA funds from previous tax years to its fund.

Paul Latham, managing director at Octopus Investments, said, ‘VCTs continue to grow in popularity… this is being driven partially by changes to pension and buy-to-let legislation, but also by those looking for a tax-efficient way to complement and diversify their portfolio.

Jo Oliver (picture below), fund manager of the Octopus Titan VCT commented, ‘Whether in healthcare, retail, industry, or financial services, there is absolutely no shortage of talented tech entrepreneurs who have the potential to completely transform their markets.

‘This is testament to the continued evolution of the UK’s entrepreneurial ecosystem, which is now recognised as one of the best places to build world-class technology companies.’