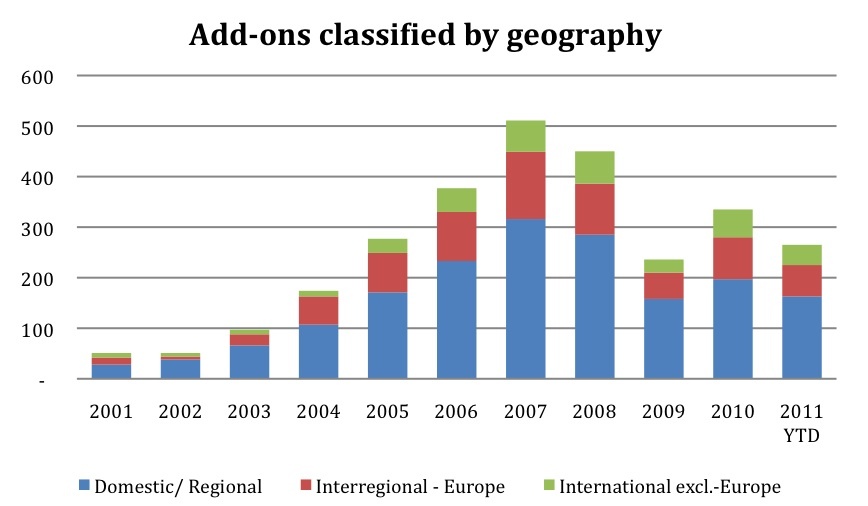

During the third quarter of 2011 buy & build activity focussed on domestic (66 per cent) and European deals (25 per cent), according to research by Silverfleet Capital (see graph below).

There were almost no add-ons done in South America or Asia, the statistics show.

The third quarter also saw a drop in the number of transactions, with 67 add-ons completed compared to 103 in the second quarter of the year and 94 in the first.

Neil MacDougall, managing partner of Silverfleet Capital, says that during the last three months private equity-backed companies were less active with add-on deals.

He adds: ‘It reflects the increase in economic and financial uncertainty and the disproportionate impact this can have on companies with leveraged balance sheets.’

The average value of add-on deals in the examined period, for which prices were disclosed, was £66 million. This figure compares to £67 million for the same period last year but is 34 per cent below the findings for the first three months of 2011.

MacDougall says: ‘Earlier this year we sold our investment in European Dental Partners (EDP). It was a build-up in the dental consumables sector consisting of five acquisitions made by a platform German company across Central & Eastern Europe.

‘EDP is a good example of private equity driving greater integration of European businesses. The company was in turn acquired by Lifco Dental International, the leader in the sector in the Nordic Region.’