Raising private equity funds is seen as the holy grail for businesses who want to grow quickly, simply because the strength of capital opens the door for rapid growth.

If your business has an innovative product that can disrupt the market as well as strong figures that suggest it can generate a large profit within five years, it’s very likely that a private equity company will be interested in you.

The idea of raising private equity is appealing for many; you can avoid pursuing methods of funding like entering the stock market where you face increased regulation, a larger board of directors and potentially a large group of public shareholders.

Private equity investors are always looking for the next big thing and they will offer their expertise for a slice of future profits. As of the end of 2024, there was £190 trillion in unspent private equity money (colloquially known as dry powder) from UK-based private capital funds. However, there are lots of critical points to consider before you decide to give up some control of your business to a private equity house.

In this guide we speak to a range of businesses who have raised private equity funding and what the best way of raising private equity funds are for UK firms.

We hope that the stories in this guide will inspire you to take the next important step of scaling-up your business and taking on the opportunities that are out there for your company.

Rob Myers, senior partner and UK head at Equistone Partners Europe explains how over the past 30 years, private equity has evolved into a central component of the European corporate funding landscape – particularly in the UK.

The standard private equity model involves a firm raising capital from a number of institutional investors, such as pension funds and sovereign wealth funds, and investing this money on their behalf into privately owned companies. Typically, the private equity firm will hold a majority ownership stake in the company, with the management team also owning a significant share of the equity. The management team continue to run the business on a day-to-day basis with strategic guidance and support from the private equity firm. After a period of approximately three to seven years the company would seek an exit, either in the form of a sale to another buyer or a public listing. This shared equity participation creates the alignment of interest between investors and managers, which has acted as a highly effective catalyst for the value creation that occurs when private equity-backed companies grow.

For institutional investors, therefore, private equity can offer exposure to fast-growing, high-potential, mid-sized private companies at a comparatively earlier stage of their growth trajectory than is available through the capital markets.

What is private equity and how does it work?

For founder-owners and entrepreneurs, selling a material stake in the business to a private equity investor, often simultaneously with the broadening of ownership amongst the wider management team, can provide the business with long-term investment to fund ambitious growth plans. It also offers access to the private equity firm’s valuable experience of supporting companies’ expansion, both organically and through acquisitions. Moreover, it enables owner-managers to realise value from the company, while either continuing to run the business day-to-day or handing over to the next generation of managers, as well as retaining a shareholding in a business funded and supported to grow in value.

These have been the established dynamics of the private equity industry for decades, but there are several trends specific to the current market.

Private equity market in 2025

According to KPMG, the UK private equity rebound of 2024 stalled in the first half of 2025. In fact, activity dipped to the lowest level since 2020. Alex Hartley, head of corporate finance at KPMG UK, told Insider Media: “As we headed into 2025 off the back of strong deal numbers last year, the expectation was that M&A activity would continue to pick up. But economic uncertainty, driven by geopolitical events and nervousness around the impact of tariffs, has meant that the deals market has been slightly more volatile so far this year, and getting deals over the line is taking longer.

“That said, the mood remains cautiously optimistic, and there are still sectors where appetite remains strong, such as business services, healthcare and technology, media and telecoms.”

Competitive environment

For business-owners looking to raise private equity investment, the ready availability of capital is a clear positive. Competition among private equity investors will allow those companies seeking to raise money to find the partner that represents the best fit from the perspective of culture, style, and potential to add value.

However, these conditions do create challenges for private equity firms, who have committed to deploying a fixed amount of capital within a specified timeframe and to generating a defined level of return for their investors. The risk for businesses is that these private equity firms try to offset the price inflation created by heightened competition for attractive companies by applying more leverage to the companies in which they invest, in order to boost the returns they generate for their investors.

A private equity investor’s track record in structuring their investments conservatively, supporting sustainable growth at their portfolio companies, and adhering to a set of established investment principles throughout the economic cycle has great importance.

Another way in which private equity firms are reacting to the competitive environment is by broadening their deal origination capabilities. There is an economic incentive for private equity investors to develop extensive networks in the UK regions, look at transactions with a greater degree of complexity, and develop specialisation in less popular sectors in order to source deals to which peers are less attracted. For entrepreneurs operating in locations, sectors, or situations where long-term investment has typically been harder to secure, this is an encouraging trend.

Impact of Brexit

Brexit, perhaps the other most prominent issue facing the UK private equity industry, presents a very different set of considerations. Industry observers have variously expressed concern that Britain’s departure from the European Union could jeopardise the financial health of private equity-owned companies or cause a precipitous fall in the levels of foreign investment into UK-focused private equity funds.

What’s clear is that, in the years since the referendum, levels of private equity activity in the UK have been remarkably resilient. CMBOR data shows that, after a sharp fall in total UK buyout values in the six months following the vote in 2016, they doubled year-on-year in 2017 to account for 30 per cent of the European total, reflecting the continued importance of private equity to the UK’s mid-sized companies.

But the Brexit vote has placed greater strain on certain UK companies owned by private equity firms. While export-oriented businesses, for example, have benefited from the weaker pound, the decline in consumer confidence has created a more challenging operating environment for high-street businesses, many of which had attracted private equity investment prior to the referendum.

An element of the additional risk associated with investing in the UK in the backdrop of Brexit is offset for those firms investing euro- or dollar-denominated funds, given the depreciation of sterling since the referendum. Nonetheless, the economic and political uncertainty associated with the Brexit process has made investing in the UK relatively more challenging. This is accentuated by the apparent political stability and improving economic performance of the Eurozone, bolstered by the advent of the Macron administration in France and the eventual re-establishment of the German coalition. By contrast, there remains a high level of uncertainty about the final destination of the Brexit process. Any manager seeking to raise capital to invest exclusively in the UK over the coming five years can therefore expect to meet a degree of investor scrutiny.

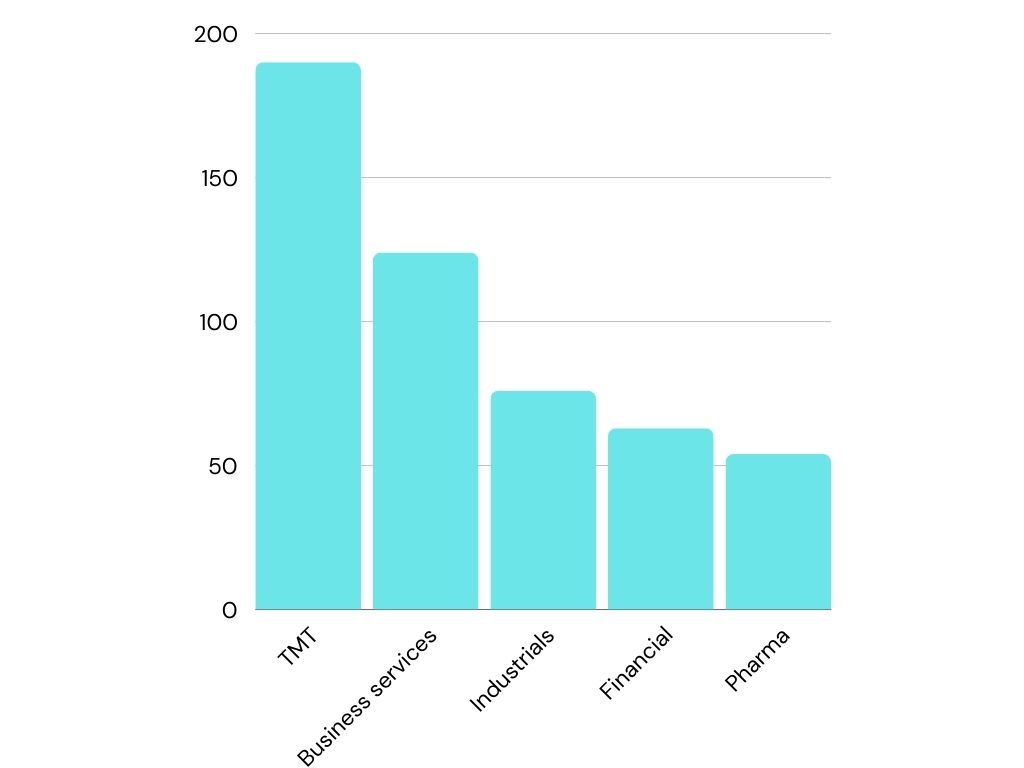

The table below from Palladium Digital shows the number of deals in Q3 2023 by sector.

Proven track records

However, UK entrepreneurs hoping to raise money from private equity need not fear a turning-off of the tap. While a slowdown in fundraising by UK-focused funds is eminently possible, we see pan-European funds with a proven track record of successfully investing across geographies continuing to flexibly deploy capital in different markets, including the UK, in response to geopolitical developments.

The key attribute of the leading private equity firms is a demonstrated ability to generate attractive returns through the cycle. Whilst current market conditions and the specific challenges facing the UK industry are likely to test this ability, we believe that private equity will maintain its established and important role of supporting the growth of the UK’s mid-sized companies over the long term.

Innovate

Geoff Peppiatt, chairman of specialist catering company Innovate, explains how private equity investment in his business has helped him to improve and develop his product and grow sales.

Innovate is a specialist educational caterer, providing a lunch service in primary schools in the South-East of England including Hatfield, Godalming and Streatham and an all-day service in secondary schools and colleges. Currently, we service around 120 different sites around the country, offering a large range of high quality, nutritious food to over 100,000 students each day. We are passionate about the role nutrition can play in improving productivity and wellbeing at school, so we work with partner schools to promote the benefits of healthy eating and to influence students to make healthier choices. Our current turnover is around £19 million.

I started the business ten years ago after I realised that school catering hadn’t moved on since I was at school – and that was a long time ago! There was a single service point, dated service counters, and an emphasis on old-fashioned meat and two veg on a plate. Less than one-third of students typically used the service, with the rest bringing in packed lunches or buying junk food, which lead to increasing levels of obesity and poor nutrition. We saw a societal problem that was addressable and could result in more children having daily access to healthy, nutritious meals.

Students and staff wanted more choice, less queueing, a nice environment to sit in, and enough food to go round. And so, from scratch, we built an entirely new, disruptive model for school catering, with exciting menus, advanced service delivery systems, and attractive environments to sit in. It was immediately successful, with take-up almost trebling from day one.

Time to scale

Things were going well, and we needed an injection of capital to support our ambitious growth plans.

While a trade sale was possible, we were keen to maintain and nurture the distinctive Innovate brand and positioning, which we felt still had huge potential.

We did, briefly, explore floating on the public markets but felt we were too small and that it would be too costly and difficult for us to manage.

Bridges Fund Management, a specialist sustainable and impact investor, originally approached us directly to have an exploratory discussion. Bridges was attracted by the organic growth opportunity presented by the school catering market, as well as the clear scope for growth through acquisition (‘buy and build’). We stayed in touch and, following various meetings, both parties were keen to pursue the opportunity.

From the outset the Bridges and Innovate teams had a good rapport, and we talked a lot together before entering into detailed negotiations. Those discussions were about social impact, strategy, the marketplace and the team. They helped to build trust, mutual respect and a shared vision of the future. This meant that when it came to it, the thorny issue of valuation was well thought through and understood by all parties.

Our discussions led to Bridges investing £8.5 million in February 2018, in exchange for a majority stake in the business. As part of this deal, Bridges was also able to help Innovate raise bank financing for capital investment and working capital. The funds are now being used to further enhance our management team, install new back and front-of-house systems and make essential investments in new contracts. With this infrastructure in place, we are well positioned for growth.

Why Bridges?

Although a couple of other private equity firms also approached us, we felt a partnership with Bridges offered a huge amount of added value.

First and foremost, we were hugely impressed by Bridges’ social impact focus. It accords with our own values, inspires our team and offers a strong point of difference in our marketplace. We were also impressed by the Bridges team. They really made the effort to understand the business properly, and their thinking was strategic and long-term. They were people we wanted to work closely with, and we sensed that they were prepared to be as radical and as innovative as we are.

Bridges also added a little discipline to Innovate as sometimes entrepreneurial businesses need to grow up a little and do a few things to tighten up governance and management. Lastly, Bridges was committed to growth – and we felt strongly that we had something worth growing.

Drawing on Innovate’s positive experience with Bridges, my top tips for growth businesses looking to scale up with a private equity partner would be:

- Focus early discussions on the business and its future, not price – so you can make sure the private equity firm shares your vision and values.

- Understand the personal chemistry – can you and the investment team work well together for the next five years?

- Remain focused on your clients and customers – how does this deal help them?

- It’s always better to be absolutely honest about everything from the beginning, because trust is all-important.

ZyroFisher

Matthew Barker, CEO of ZyroFisher, discusses the process of finding the right private equity company for his business and how non-financials are just as crucial to a private equity deal as a financial investment.

ZyroFisher is a cycling parts and accessories partner and distributor and represents over 50 global brands such as Giro, Bell and CamelBak. We do that by supporting brands with local knowledge, marketing expertise and logistics and our role is to work with a global brand to push their products to the right retailer.

I’ve served as CEO of the company since 2016 and prior to this, I was finance and IT director for four years so I know the company well.

Following private equity investment by Palatine and LDC in 2017, ZyroFisher will be expanding into France after acquiring Royal Velo France, becoming one of the first distribution firms in France to be PE-backed. The Royal Velo France deal is the third private equity deal that I’ve completed. The total value is undisclosed but it’s worth between £2 million-£30 million and the investment has given us the ability to take new opportunities in France and to disrupt the French market by applying what we’ve learnt in the UK. To ensure a successful private equity deal you need non-financial resources like contacts, how-to-help and a platform as well as financial resources. Investment means we can accelerate things forward and can capitalise if our work in France arises from other opportunities.

Why France?

We decided to take a step outside our core UK market having seen a real opportunity in the French market.

The cycling sector in France is quite similar to the UK as the number of markets, the products that are available and total supply is the same. The real difference compared to the UK is the advancements of retailers.

Our competitors tend to be large family-owned businesses in France and I believe we can use our expertise to be successful in the country. If we bring our knowledge, capital and strategy we can shape the market in the future.

I’ve known the private equity firm Palatine, who provided us with the PE investment, for a number of years because they’re strong in the North of England in the mid-market area. When you become a director you will form relationships with private equity companies who could be relevant to the future growth of your business. Before we decided to work with Palatine we took lots of recommendations from the corporate finance adviser that we work with – KPMG – who told us that the investment would be interesting for them.

Focus on the process

The key thing to consider is that every process is different because your business is different every time. Investment is more about gaining a vision with a partner and that’s very critical. It’s important to determine that the PE house would work with you in terms of style and that their segment is aligned with yours. As a management team you don’t really know what the ins and outs are with the private equity house are. Therefore the right advisers are crucial. We used Christian Mayo’s team at KMPG to gain a better understanding of what the deal would entail for ZyroFisher.

We chose to work with Palatine because their people were aligned with our objective, and we wanted a house that had an appetite for expanding into Europe and for a buy and build strategy. The great thing about them was their style and approach. It’s vital that you interact well around the boardroom table and whether the private equity company is friendly and approachable. What was great about them was that they were very excited about the future opportunity so from an individual point of view they were a good fit for us.

We have worked with about five of their team from start to finish including investment director Kieran Lawton and Ed Fazakerley. As a house they were very strongly engaged in the process and our conversations generated a very good feeling for us.

David Phillips

Nick Gill, group CEO of property furnishing and design supplier David Phillips explains how raising private equity funding has helped him to grow his business across Europe.

We work with developers, investors, house builders, property managers, student accommodation providers, housing associations and local authorities. We were founded in 1998 in London and now have operations in Manchester and Birmingham and we are increasingly working across Europe. Our mission is to be the property market’s premier furnishing service.

Initially I acquired the business from its founders in 2005 with a partner. By 2012 he and some other shareholders wanted to exit, and we decided to seek a replacement capital transaction with private equity. We raised £8 million and it took about five months from beginning to end which, from prior experience, is neither excessively long nor very quick. It wasn’t difficult because we were able to present an attractive growth story in growing markets. That’s not to say that it wasn’t stressful at times! The preparation for a capital raise and bringing in new investors requires careful thought and management. Since acquiring the business its revenue has grown from £3 million to around £17 million through organic growth and acquisition.

Our biggest barriers to growth are around putting in place the right systems and processes to enable us to scale profitably. Our business requires a careful management of the fixed cost base to ensure that the business is structurally and systemically profitable – investment in processes and systems is a key part of that. We haven’t always been as good at this in the past as we needed to be and are determined to improve this part of our growth.

Traditionally people that want to provide furnished accommodation have to spend a disproportionate amount of time arranging the furniture part of their service. Often this involves meeting various delivery companies at their property and then physically assembling new furniture and arranging for the disposal and recycling of old items. David Phillips provides a comprehensive solution for them. We deliver, assemble and install all items; we can deliver as little as a mattress or a bedside table for a single property through to hundreds of apartments at a single development furnished on a turnkey basis. We add a high service element to the traditional retail experience to deliver a totally different service level.

We worked with a corporate finance advisory house, Clearwater International, to canvass the market and draw up a long list of potential private equity houses that would be interested in investing in us. We went through a formal pitch process and created a shortlist of firms that were then invited to do due diligence and make investment proposals. We then moved through management presentations, with the firm doing some market analysis through to negotiation of documentation and close.

Understand what investors are seeking

We worked with a team that had good experience of the PE world which is key. Beyond that, you need people who understand the process; are familiar with the PE houses’ quirks, idiosyncrasies and defining slants and can also explain clearly to the wider management team what the investors are looking for.

We made substantial investments in inventory, IT systems and processes as well as sales and marketing efforts.

In addition, we increased our presence outside London through the acquisition of a competitor in Manchester in 2013 and then one in London in 2015.

The process itself was well managed and relatively straightforward: raising capital is a pretty well-worn path and both sides (if well advised) should be able to march through the steps reasonably easily.

The real change comes after the investment; we raised money to finance growth in part; however, the larger reason was to help professionalise the business and its management. This process hasn’t been without its tough moments as outside investors will differ in their views and approaches from founders or incumbent management. If I was to do anything differently it would have been to spend more of the money on tech, earlier (but you need processes before you do that.)

However, we have more than trebled in size since taking on board the investors, so it has been broadly positive!

Top private equity firms in the UK

If you have a business that could benefit from private equity investment, here’s a short list of UK private equity firms and the sectors they hold investments in UK companies in:

Bridgepoint Capital: Business and financial services (10), advanced industrials (1), healthcare (10).

Piper: Current investments include sectors such as food and drink firms such as Propercorn and Yard Sale Pizza (3), health and beauty (2), travel companies (4), pet brands (2), one florist and one jewellery company.

The majority of investments made by KKR are in IT (35) and healthcare (23), including investments in Biotage and The Stepstone Group. They’ve also taken a stake in two energy firms, 12 communications services companies, ten financial firms and 19 industrials companies.

Apax Partners has invested in several UK-based businesses including fashion firms Matches Fashion and New Look Group, services company Safetykleen, logistics firm Marken, online automotive marketplace Auto Trader and challenger bank Tide.

This article was originally published by Michael Somerville on 14 September 2018.

More on private equity

Finding the right private equity partner for your business – Growing a company successfully and sustainably is serious business. But finding the right partner to support you on the journey can make it more efficient and fun, says Tim Smallbone