The private equity market weathered the downturn more effectively than most believed it would, coming out the other side ready to launch a new wave of investment.

But, as the investment cycle that began before the recession comes to an end, the issue of new fundraising rears its ugly head and threatens to stagnate the progress made by private equity firms.

Arthur Stewart, partner at law firm Simmons & Simmons, says: ‘There hasn’t been the degree of short-term consolidation that we might otherwise have thought.’

Simmons & Simmons was involved in the recent acquisition agreement for UBS Investment Bank to buy out British-based investment management business Gartmore Group.

Stewart sees an emerging trend of consolidation being that of the merger of managers, as displayed by the Gartmore fund of funds deal.

He explains, ‘Other types of consolidation take place by private equity firms not being able to raise new funds, so effectively the managers aren’t able to continue to be in the private equity business.’

Managing partner at GMT Partners, Tim Green, says the issue of consolidation has been frequently discussed but has, as yet, failed to properly materialise.

Green explains, ‘I’m not sure we’ll see very much of it at all other than on the fund of fund side where people are looking to garner more funds under management.

‘We are certainly seeing an asset pricing bubble right now, over and above the suggestions that we will be hitting a second dotcom bubble, a suggestion that has been banded about again after the Microsoft deal for Skype.’

When looking at limited partners (LPs), Green believes it is a question of quality. Are the team high class, disciplined and not rushing to put the money to work?

He views the return to higher fees and lower returns as a reason for funds failing to realise new capital and the private equity market consolidating slightly.

‘Money drives consolidation, as that money flows to the survivors and those that can’t raise funds go out of business,’ says Stewart.

In April, US-based private equity manager HarbourVest Partners acquired Swiss-listed fund of funds firm Absolute Private Equity, fuelling the possibility that fund of funds are marked for consolidation as investors seek to reduce the fees they pay and take private equity investing into their own hands.

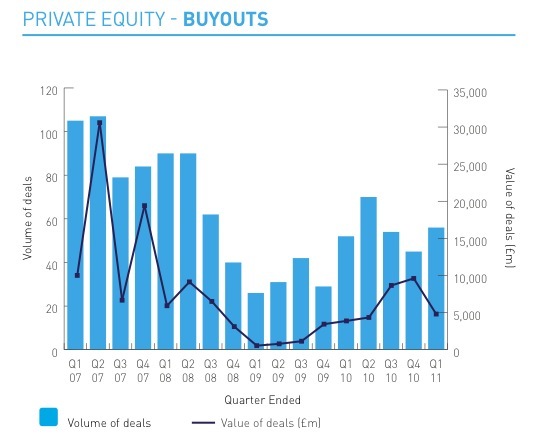

In the first quarter of 2011 private equity buy-outs reached 56, up from the 45 achieved in the final quarter of 2010. However, it is the values of exits and buy-outs which have plummeted during 2011, with both down by nearly 50 per cent following a strong end to 2010 (see chart 1).

Research, produced by accountancy firm PKF, suggests an upsurge in smaller, lower-value deals which are keeping the market active, but not producing the bigger deals that characterised the end of 2010.

Armando D’Amico, managing partner at private equity fund placement advisory firm Acanthus Advisers, believes that if any consolidation is to occur it will be among the LPs.

D’Amico notes, ‘Over the last couple of years there was a lot of money raised but very little invested. So the big capital overhang, which was £140 billion and is now £120 billion, needs to be invested.’

He adds: ‘It’s going to be huge as there is going to be a flood, we estimate that just in the European mid-market there will be 100-150 funds coming to market between 2011 and 2012.

Speaking on general partners (GPs), D’Amico predicts that of the 200 GPs in Europe, there will be a bottom tier of around 30 firms who are going to find it very hard to raise new funds.

‘We can comfortably say that not everybody will get funded – it’s mathematically impossible,’ he explains.

Stewart sees the most notable change in the private equity market as coming from the listed manager sector of the market.

‘You might see opportunities for consolidation come out of increased regulatory pressure,’ he says.

Stewart does not see a return to the 1980s when he says you could ‘count on one hand the number of fund of funds that were in business’. He believes it is inevitable that there are going to be fewer over the next couple of years.

Green concludes, ‘Even if people are struggling to raise funds, they still have a run-off time, so it takes a long time for the partnerships to effectively wind up. We are yet to see the full impact of the downturn and its impact on private equity.’