Despite political turbulence, 2016 was another bumper year for M&A activity globally, with over 46,000 transactions completed for the second successive year. The technology sector produced some of the most significant transactions of the year and led all sectors with $612.9 billion closing in on the 2015 record of $691.6 billion according to Dealogic.

Here is our review of the 301 deals recorded on Kingston Smith’s technology deal tracker in 2016.

Billion pound mega deals

2016 saw three UK technology companies acquired in deals exceeding £1 billion underlining the strength of the UK tech sector and the confidence in the UK as a place to do business.

ARM Holdings was sold to Japan’s Softbank Group for £24.3 billion, a 43 per cent premium to its stock market value and was undoubtedly the biggest Tech M&A story of the year. ARM has for a long time been a much celebrated British success story and the sale to Softbank underlines this. The deal was also an immediate post Brexit boost to the sector underlining that the UK is open for business.

Two further billion pound deals saw US based Godaddy announce a deal to acquire web services provider Host Europe Group for £1.4 billion and China’s biggest online travel company Ctrip announced a deal to acquire Skyscanner also for around £1.4 billion.

Inbound activity continues

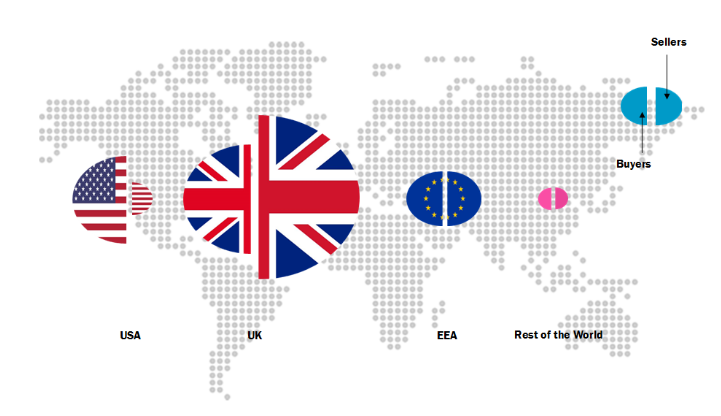

The three billion pound mega deals were indicative of the underlying trend of UK companies being acquired by overseas buyers. 52 per cent of the deals analysed involved a cross border transaction with sales to overseas companies making up 60% of overseas transactions. This trend has started to raise alarm bells in Westminster with Chancellor Phillip Hammond announcing plans to boost funding for start-ups to encourage them to resist selling to overseas acquirers. Despite this we expect the trend to continue however as the strength of the UK economy, quality of the tech and finance communities coupled with the post-Brexit sterling devaluation meaning that the UK is an extremely attractive proposition for overseas acquirers. The infographic below shows the origin of buyers (left segments) and sellers (right segments) for cross-border transactions involving the UK:

US acquirers dominate

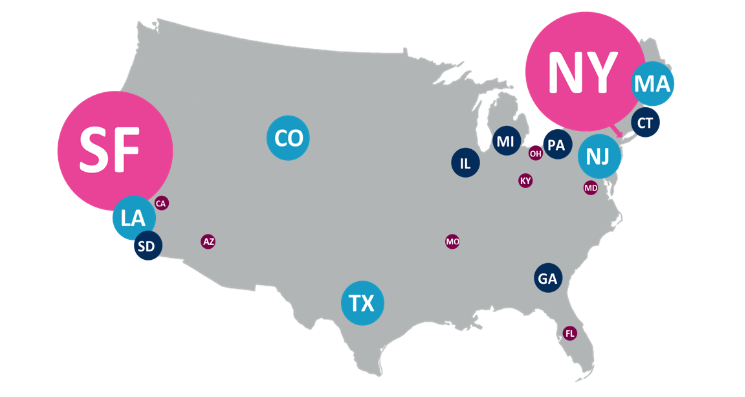

The US continues to be the most common location of acquirers of UK tech companies with over 50 per cent of overseas buyers being located in the US. The infographic below shows that San Francisco and New York are the most popular headquarter locations for US tech acquirers.

The up-and-coming tech hubs of LA, San Diego, Denver, Austin and Dallas are also locations that should also be targeted by UK tech companies looking to sell or expand into the US. If you are interested in selling your company or setting up in the US or elsewhere overseas, Kingston Smith and our contacts in the $1 billion network, Morison KSi can assist.

Outlook for 2017

The global political situation will continue to be a major topic of conversation in board rooms globally and will have a major impact on M&A activity for the foreseeable future. Whilst sterling remains relatively low compared to the US Dollar, inbound activity will continue to dominate as high quality UK technology businesses can be acquired at relatively low prices by overseas buyers. The UK start-up scene continues to be exceptional especially with the presence of a favourable funding environment. We expect many more British tech businesses to follow in the footsteps of ARM and Skyscanner.

This article was prepared by Nick Winters, Head of Technology and Partner, John Cowie, Partner, and Paul Winterflood, Manager, at Kingston Smith.