Exit Strategies

Tag

Capital Gains Tax

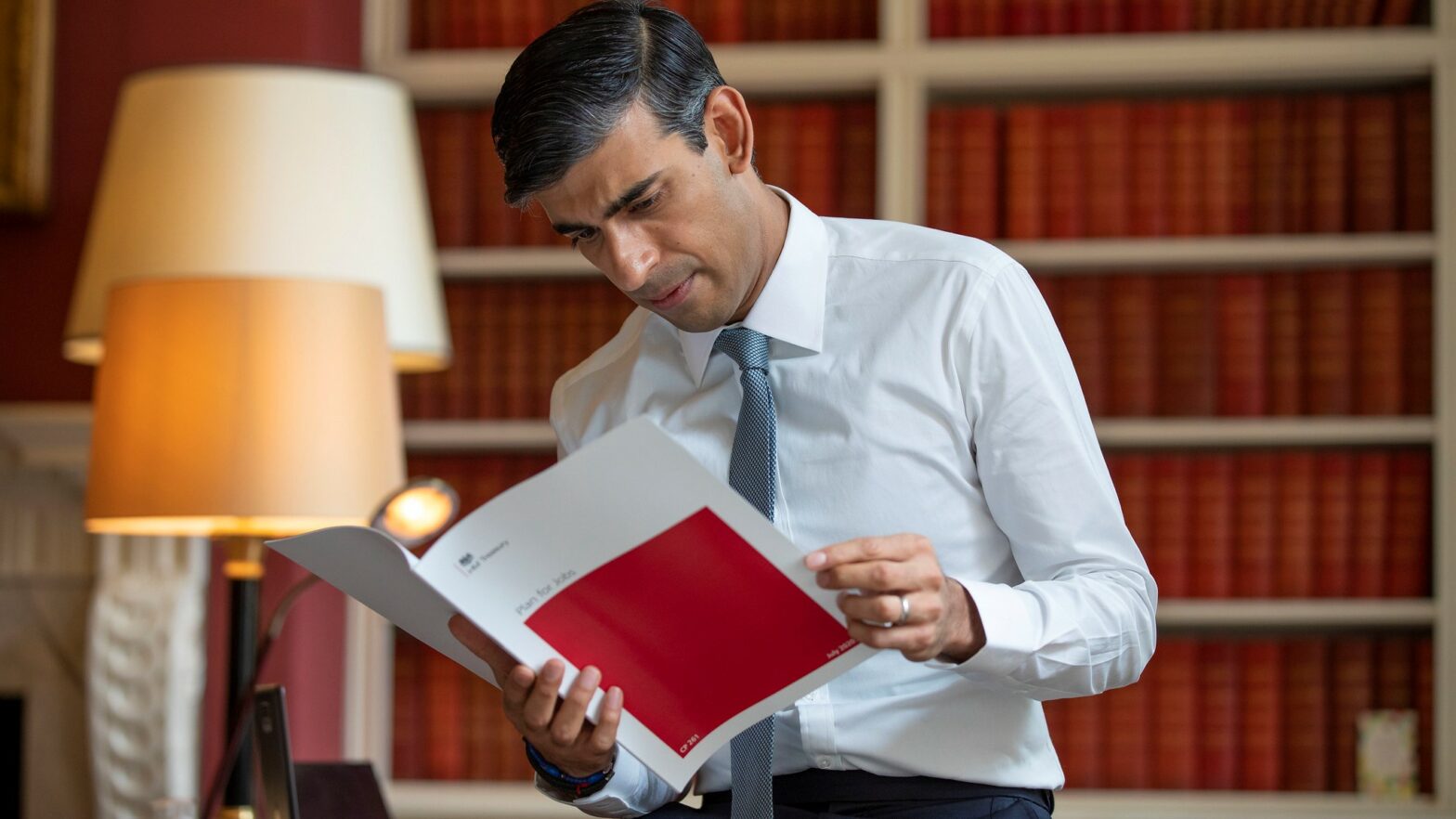

Exit Strategies

Entrepreneurs’ relief facing increasing calls to be scrapped

Alternative Finance for Business

Taking advantage of the tax gap

Venture Capital Funding

The dangers of raising CGT

Opinion

We need to get CGT right

Recommended Content

Partner content

Why upgrading your tech regularly will help your business grow

Accounting and Finance Software

Desktop vs cloud accounting: What to consider

Accounting and Finance Software