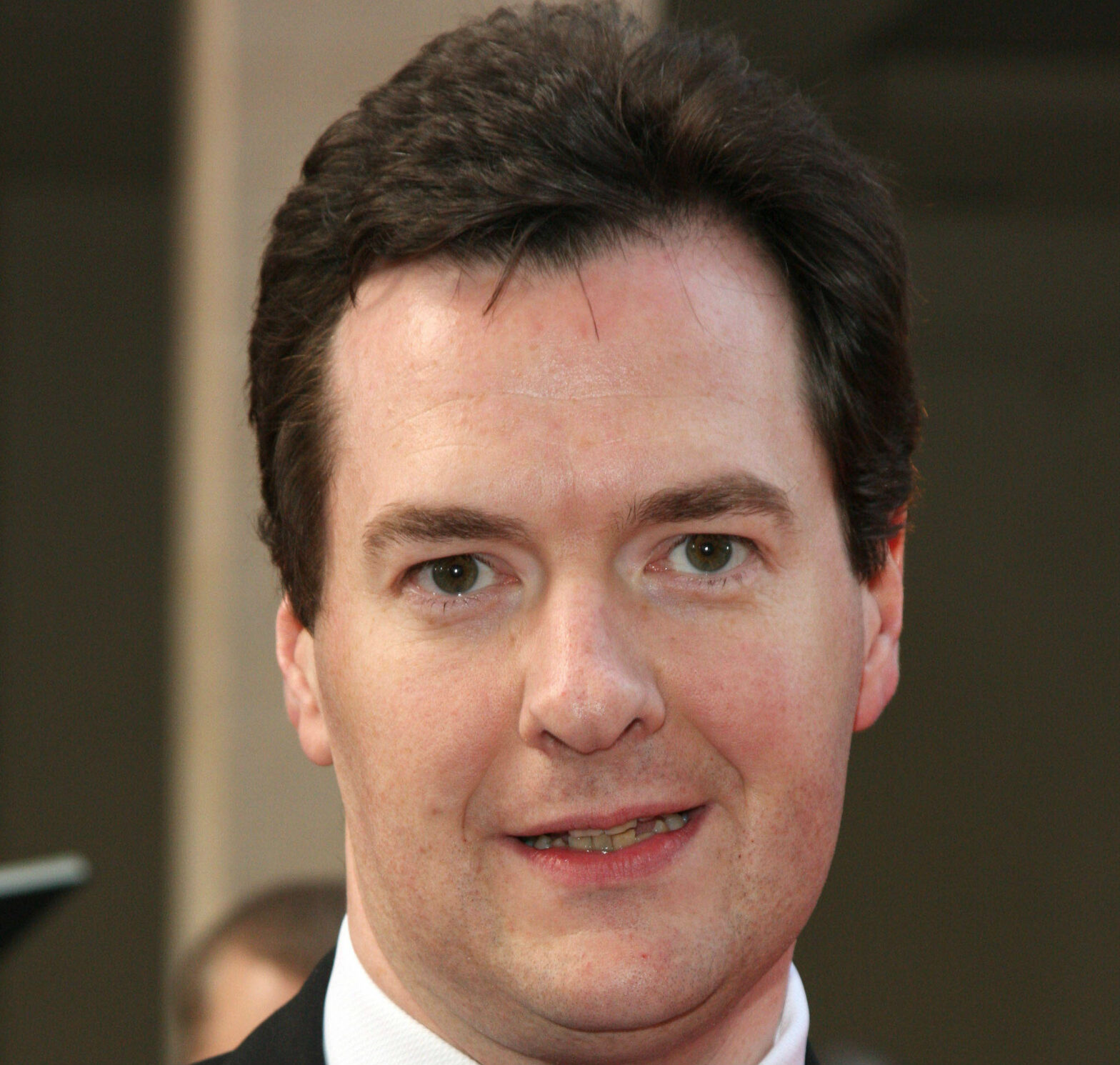

“Britain deserves a pay rise”, said chancellor George Osborne half way through his Summer Budget speech on Wednesday.

There’s no doubt that he is right about that. The economic recovery is being mooted as a huge success for Osborne and the government – and rightly so.

As Osborne himself pointed out the Office of Budgetary Responsibility (OBR) is forecasting growth of 2.4% in the coming years – faster than any other European or North American country.

But low productivity is still a thorn in the side of the UK economy and no one knows how to fix it. Subsequently wages, even though they have showed some signs of recovering, are still much lower than one would expect given other economic indicators. Put simply – if the country isn’t making and selling enough it cannot afford to pay people more.

No one (well no one sensible at least) is suggesting this is the fault of the workers themselves. So Osborne decided that the lowest-paid need a financial boost to keep their standard of life as high as possible.

The headline figure is £9p/h by 2020. Given that this is to be a compulsory benchmark it certainly seems like a large boost for those currently on the National Minimum Wage of £6.50 (for workers aged 21 and over).

Huge cheers on the Conservative side of the house greeted this announcement. Iain Duncan-Smith celebrated like he’d just personally solved the productivity puzzle – which was an odd moment in itself.

But is it really the magic rabbit that Osborne was hoping for? A mere 24 hours after the announcement cracks are starting to appear in the policy which could see the seemingly triumphant chancellor attacked from all sides.

Is it really a pay rise?

The idea of the living wage is that it gives people enough money to live on according to the calculations of the Low Pay Commission (LPC).

This is based on factors including market rents, the price of essentials and other regional and national factors.

The current non-compulsory benchmark set by the LPC is £7.85p/h outside of London and £9.15p/h inside the capital. Osborne’s proposals include plans initially to introduce the National Living Wage of £7.20p/h in April 2016.

>See also: Summer Budget 15 – full reaction

The glamorous £9p/h figure will not come into effect until 2020 – by which time it’s highly likely the national living wage figure, as calculated by the LPC, will be higher than that anyway.

There are two other crucial factors at play. As Adam Bienkov points out on politics.co.uk, living wage takes into account tax credits and has a London weighting. Osborne’s proposals do or have neither

Osborne’s right to call his policy a living wage has also been questioned by Rhys Moore of the Living Wage Foundation.

His view is that “without a change of remit for the LPC this is effectively a higher National Minimum Wage and not a living wage.

“What about London? We have been working with the mayor of London for seven years and there’s a London Living wage rate that recognises the higher costs in the capital, currently £9.15 per hour,” he said.

“These changes will not help the 586,000 people for whom even the 2020 rate announced today would not be enough to live on now.”

The final point is that this will only be available to those aged 25 and over. Workers under 25, who need the most support, are completely left out of the deal. With working tax credits obliterated and maintenance grants at university replaced with loans, the future for working class young people looking to get ahead is starting to look a little bleak.

I don’t for a second want to condemn any measure that gives the lowest-paid more money. For workers aged 25 and over outside of London this will achieve that aim. But a living wage it is not.

And by calling it such Osborne risks stymieing the real living wage campaign. If employers can turn round to workers and tell them that the low salary they are being paid is in fact a living wage, where can they go from there?

This policy was designed to paint Osborne as a kinder chancellor who is committed to helping the working poor. But Osborne has not gone far enough to deflect criticism levelled at him for savaging tax credits and leaving the young behind.

To absorb the impact of criticism that small business groups will inevitably aim at Osborne in the coming weeks, he needed the compassion angle as a pretty hefty buffer. Sadly for him, the living wage as it stands will not provide it.

Entrepreneur unrest

From the completely opposite end of the scale Osborne is already under pressure from small business groups and owners.

Entrepreneurs Network’s Philip Salter wasted no time in condemning the new living wage as a “bad policy for entrepreneurs and the UK”.

“The government should leave the decision of what level to set any wage floors in the hands of the experts at the Low Pay Commission, so that business owners aren’t forced to sack employees if payroll costs go up too much,” he warned.

Salter was even unimpressed with the chancellor’s conciliatory gesture of increasing the Employment Allowance – allowing businesses to employ up to four people on the new living wage without paying a penny in NI contributions.

“If the chancellor wanted to help the low paid, he should have slashed Employers’ National Insurance, 70% of which is paid for by the employees, rather than just increase the Employment Allowance from £2,000 to £3,000 a year,” he suggested.

Even the normally diplomatic Federation of Small Businesses (FSB) expressed concern over the announcement – admittedly still in its own understated way.

National chairman John Allan warned that many small firms will find the new compulsory wage “challenging”.

Osborne himself admitted that, in a consultancy with the OBR, it was agreed corporate profits will most likely be hit by about 1%. He brushed this off in his speech but it is significant. And worryingly there was no talk of the impact specifically to small business.

A lower corporation tax (down do 18% by 2020) and the increased Employment Allowance are welcome, but no one for a second believes it will completely temper the impact of the higher wages.

Now that small businesses also face an effective cut to Annual Investment Allowance, down from £500,000 to £200,000, they will be given more than one headache over the course of the parliament.

Andrew Jackson of Fiander Tovell LLP, and the chairman of the UK200Group, spelled out the full potential impact for embattled SME employers.

“The introduction of the National Living Wage is going to be a big cost for some SMEs,” he said.

“Even though it has been partially mitigated by an increase in the employment allowance, the overall effect of paying higher wages will ultimately be smaller profits, which will be taxed more heavily in shareholders’ hands.

“A number of other measures, such as the withdrawal of amortisation for goodwill, and the restriction of pension contributions, may also make life more taxing for owners of SMEs.”

So the small business community is less than impressed with having this compulsory minimum salary thrust upon them. The morality of this is an argument for another day – for now all that matters to Osborne is how his policy is playing out.

Shot by both sides

With swingeing cuts to benefits and the removal of a lifeline to the poorest university students, what Osborne really wanted from the living wage was a policy that would paint him as a friend to the working poor.

But whether through a lack of funds or just an unwillingness to deliver more, he has fallen far short. In addition to this, he has risked angering the small business community, many of whom already feel betrayed by a perceived bias in favour of large corporations.

When the sheen comes off this announcement there is a real danger that the chancellor could be left facing condemnation from two disparate groups he desperately wants to be seen to be helping. For a politician as astute as Osborne, this could prove to be a rare and costly error of judgement.

But is it really the magic rabbit that Osborne was hoping for? A mere 24 hours after the announcement cracks are starting to appear in the policy which could see the seemingly triumphant chancellor attacked from all sides.