London-based fertility clinic business Create Health has secured a £5 million investment from ISIS Equity Partners.

The investment has been made through the Baronsmead VCTs and means that Create Health joins the likes of nursery operator Happy Days and spinal implants business Surgi C in ISIS Equity Partners’ healthcare and education portfolio section.

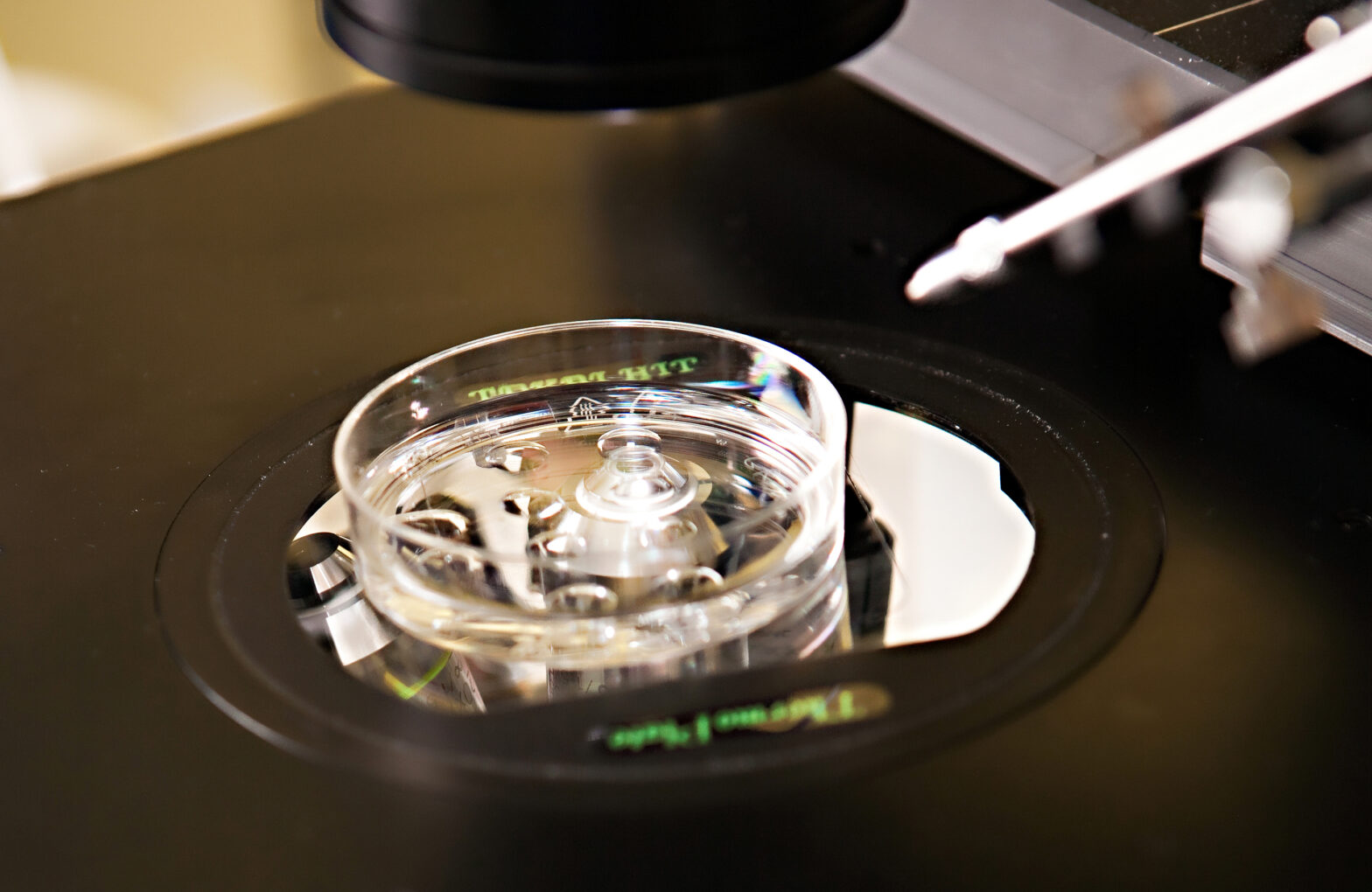

Create Health was founded by Geeta Nargund and Stuart Campbell in 2000 and provides fertility services from its two London clinics. As part of its services, Create Health supplies natural and mild in vitro fertilisation (IVF) and in vitro maturation (IMF) treatments.

The cash from ISIS will be used to open what the business describes as a ‘flagship’ clinic and a European Centre of Excellence in central London in late 2013. Create Health says that the clinic will have capacity for some 3000 IVF cycles, and an infrastructure to educate public and train clinicians in natural and mild approach.

Nargund, CEO and medical director at the company, comments, ‘I am delighted that ISIS are helping to expand a service which prides itself in achieving success based on ethics, safety and quality.

‘Create will continue to drive the agenda for protecting “health and welfare of mother and child” through it’s “quality and not quantity” approach.’

More on ISIS Equity Partners:

- Wiggle rides over to Bridgepoint

- ISIS serves up expansion capital to Pho restaurant chain

- Management buy-out for Autologic

As part of the investment, Neil McCausland will be joining the business as chairman. McCausland is chair of Skin Clinics and Snow & Rock as well as non-executive director at the Post Office. Another new addition will see former Alliance Medical CEO Philippe Houssiau as non-executive director.

Benoit Broch, investment director at ISIS Equity Partners and new board member at Create Health, says that the investment firm formed an ‘immediate friendship’ with Nargund upon meeting in 2012.

He adds, ‘We believe Create’s medical philosophy is compelling and are excited about the opportunity to support the provision of broader access through the development of a state of the art flagship clinic.’

The transaction is the third of 2013 for ISIS Equity Partners following its sale of Micro Librarian Systems to Capita and disposal of LBM Direct Marketing to Stream Global Services.