A London-based digital banking service, Loot, has raised £2.2 million in seed funding, in a round led by Power Corporation’s corporate VC, Portag3, and Speedinvest. The ‘neo-bank’ is used by over 50,000 people, and aims to expand its reach to Millennials across Europe.

Loot is aimed at users who increasingly run their lives from their smartphone, which is a projected 38 million Brits between 16 and 65 in the UK alone. Ollie Purdue, the 24-year-old founder of Loot, created the company in 2014 in his final days at university after struggling with money management apps and clunky banking interfaces at university. His vision was to change the relationship between young people and their money, no matter how high or low their balance. In December 2016, Purdue launched Loot’s full current account, designed to replace the conventional bank, including built-in tools to help manage money.

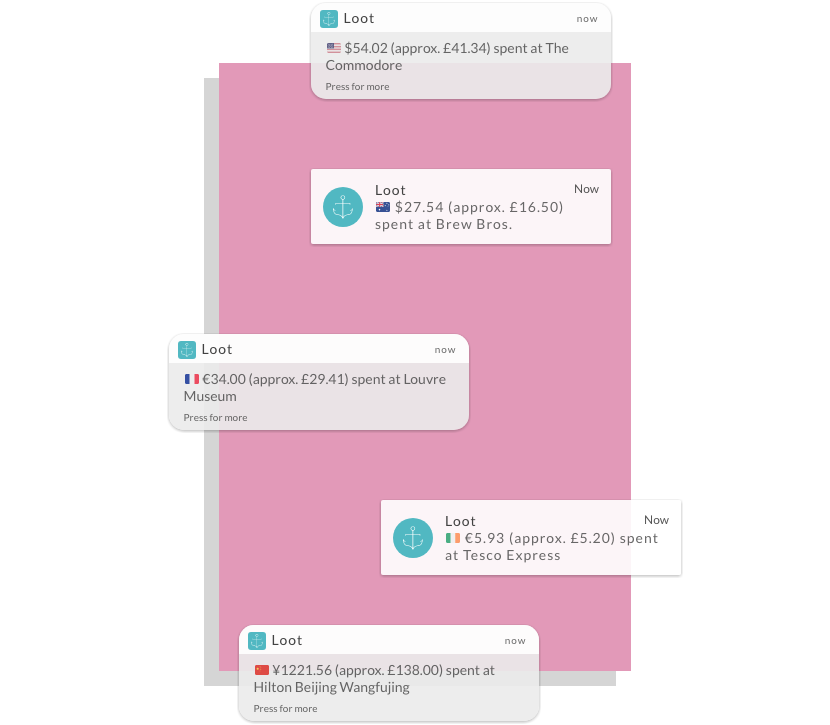

“We want our users to know more about their spending, so they can do more with their money,” Purdue said. “This means letting them know how much they can spend freely (and safely), so that they can save and pay their bills. Loot’s goal is to work out the best way to manage our users money, so users can focus on what they’re really interested in. Right now we can replace a traditional bank account and help our users manage their money and track their spending through our app.”

The latest investment will be used to help implement the mid-term plan to make Loot fully automatic, while looking to see how they can integrate the best social features into the platform.

“Loot has already had a huge impact on their target market, which consists predominantly of students and young professionals,” Steph Choo, managing partner at Power, said. “We’re looking forward to Loot’s expansion over the next year and beyond.”

The new funding will also be used to take on the competition, which Purdue admits is on the rise. “I guess there are two types of competition for us at Loot. The banks and the money management apps,” he said.

“The banks have significant market share, but struggle with helping people understand their money, and, in my opinion, they also struggle with tech and branding.”

“For example, since I started Loot, my Natwest app hasn’t materially changed in any way I would notice it. That’s too slow for me as a user,” he added. “The new fintech banks are much better at this, but none of us are at scale yet. Money management apps approach the user problems at a different angle but as they don’t own the accounts, it’s hard to be proactive for the user as you can’t help them move their money. Also, with a money management app you are still stuck with having to choose a bank! At Loot, we are trying to merge the two so we can be the only financial account you need.”