Cornerstone VC has launched a £20m fund to invest in entrepreneurs from diverse backgrounds.

The fund will focus on tech-enabled companies at pre-seed and seed stage, writing cheques of between £250,000 and £1m with capital reserved for follow-on funding.

Cornerstone plans to invest in up to 40 companies with a “significant proportion” based outside of London.

It is backed by BGF, founded by high street banks after the financial crisis to take stakes in smaller private companies, Atomico, the venture capital firm created by the co-founder of Skype, and the Hg Foundation, a branch of the private equity business Hg Capital.

Building upon the findings of its Access to Venture Capital report, the VC will look to address the equity funding gap for entrepreneurs often overlooked by the wider funding community.

>See also: Black founders raise just 1% of pre-Seed venture capital funding

In particular, it will target underrepresented management teams with either “inherent diversity” – which Cornerstone defines as what you were born with (gender, ethnicity, age) and “acquired diversity”, meaning what you accumulate through life experiences, such as culture, education and functional skills.

Recent investments from the team’s pre-seed angel portfolio include ByRotation, Passionfruit, Hutch and MoonHub.

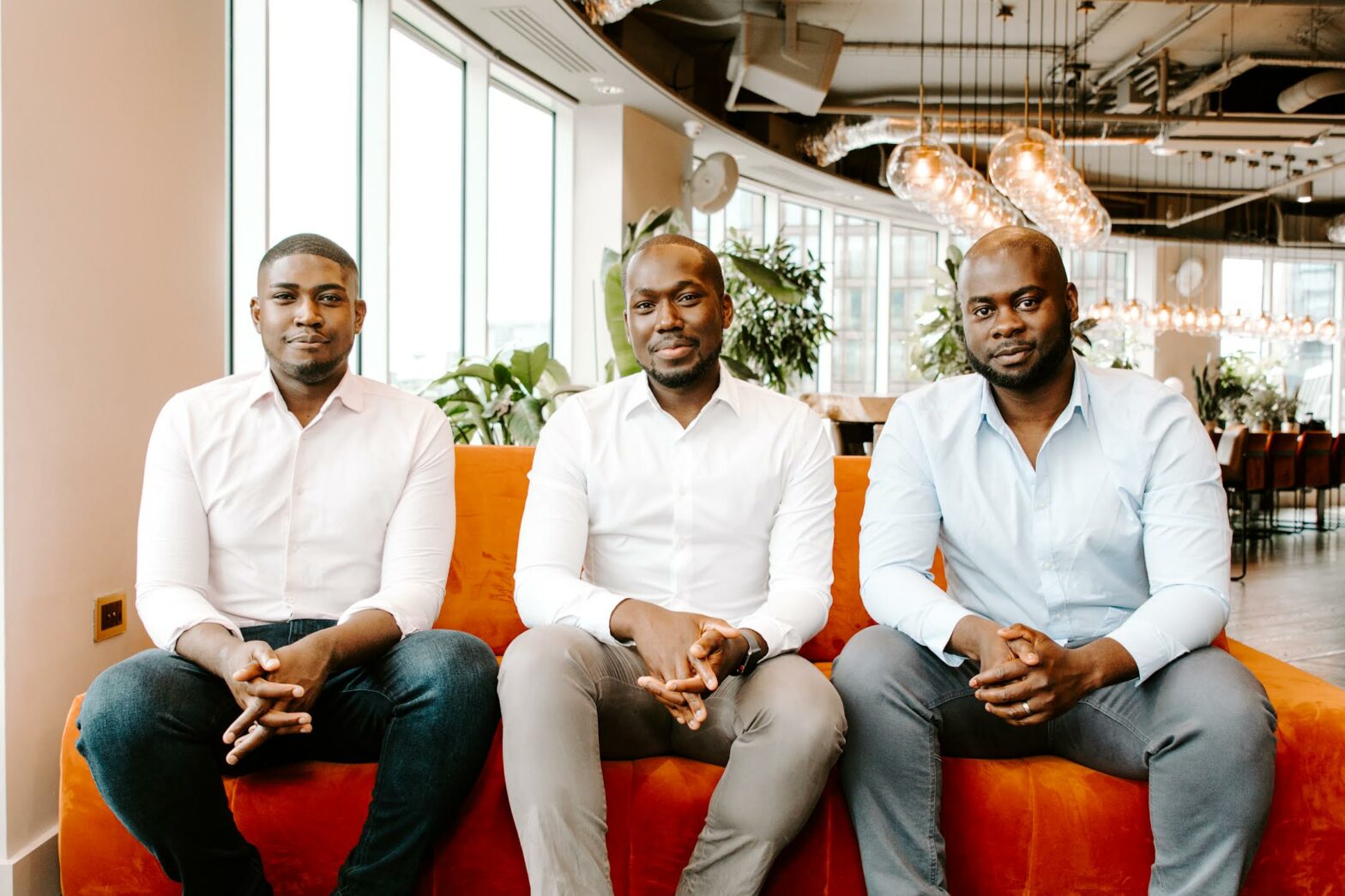

Cornerstone VC is led by Rodney Appiah, who also co-founded Cornerstone Partners in 2016, alongside partners Edwin Appiah and Wilfred Fianko. Cornerstone’s angel network will also receive a share of the fund’s profits.

>See also: Workforce age diversity – six top tips to tackle the challenges

Appiah said: “We are on a mission to put teams at the heart of our investment approach, believing diversity is key to driving outperformance. We are looking for businesses that are intentional about team composition, can excel in high growth environments and are truly obsessive about execution. People first, software second.

“Contrary to perceptions around a pipeline problem, we don’t see any evidence of that. We meet more than 500 diverse founder led businesses a year and our own data indicates that there is a growing pipeline of high growth, innovation led, investment opportunities led by diverse founders, particularly at pre seed and seed stage requiring further institutional investment.”

Stephen Welton, executive chair at BGF said: “We are delighted to be backing Rodney, a BGF alumni, and the team at Cornerstone VC in the launch of its ground-breaking seed-stage tech fund, which complements BGF’s established minority investment for small and mid-sized growth businesses.”

More on diversity funding

Ada Ventures raises £27m to invest in diversity-driven tech start-ups