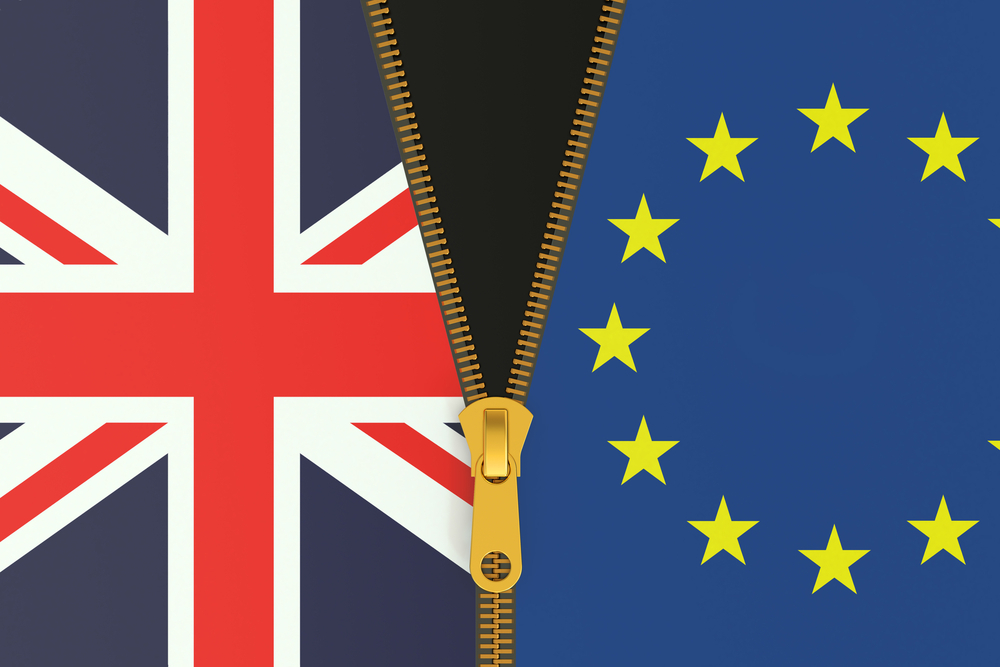

New research into business sentiment reveals greater support for Brexit, concerns over another Scottish independence referendum, and Boris Johnson as most likely next PM

With the EU referendum only months away, polls and surveys on business outlook abound. A poll of 320 senior business leaders of high growth companies revealed reduced support for staying within the EU, and an increasing focus on business growth as a measure to balance any economic uncertainty this may bring.

The survey, carried out by BGF (Business Growth Fund), indicated growing support for Brexit. 63 per cent of business leaders believe that British businesses are better off inside the EU – down from 82 per cent last year.

A mixed bag

While support for Bremain is strong, 71 per cent of respondents acknowledged that the UK’s membership of the EU gives British businesses invaluable access to European markets. 59 per cent believe an EU exit risks stifling business growth. Looking ahead at the potential implications of a leave vote, 47 per cent of respondents say that Brexit will prompt multinational companies to relocate operations overseas while 71 per cent believe that it will trigger another Scottish independence referendum.

On the other camp, more than two thirds of the surveyed business leaders claim that Britain’s membership of the EU saddles British business with unnecessary and problematic regulation.

While over a third believe Brexit would leave British businesses to contend with a skills shortage, 50 per cent of the surveyed business leaders disagree.

According to the survey, the biggest barriers for British businesses are macro-economic conditions and instability in overseas markets–both triggered by the EU referendum.

Despite the uncertainty of the situation, 87 per cent of the surveyed leaders are prioritising business growth over the next quarter, compared to just 11 per cent who plan to consolidate or remain the same size.

“It’s also clear that despite uncertainty prompted by the vote, and economic instability overseas, British businesses remain committed to growth. In uncertain times it is crucial that businesses get the support they need to innovate, export, grow and prosper,” Stephen Welton, chief executive of BGF noted.

A knock-on effect

A poll by ICSA: The Governance Institute and The Core Partnership reveals that only 41 per cent of UK boards have considered the result of the referendum on the UK exit of the European Union and the effects that this might have on their organisation. Close to half have not considered it at all.

“Whilst not all organisations operate withinEurope, it is surprising that boards are not at least considering the knock-on effect that an exit could have on the underlying economy. If sterling goes into freefall this will have an impact regardless of whether or not they have import or export agreements with Europe,” says Simon Osborne, chief executive of ICSA.

“Boards really need to be thinking about some of the potential implications like staff supply, grants, access to markets and regulatory arbitrage now, whatever the sector.”

Boris for PM?

According to business advisory specialists, FRP Advisory, England business owners, regional banks, lawyers and accountants are divided equally into thirds between the stay, leave and undecided camps. “With just three months to go until the referendum it is apparent that businesses feel they are simply not receiving the simple economic arguments for and against EU membership to help them make up their minds. Our snapshot of business is that the country remains deeply divided with the voting on a knife-edge, but that once business is given a coherent vision of the economic arguments for staying in the EU then the current crucial block of a third who are “undecided” tends to veer towards the stay camp, giving the stay vote a substantial lead,” Glyn Mummery, partner at FRP Advisory explained.

According to business advisory specialists, FRP Advisory, England business owners, regional banks, lawyers and accountants are divided equally into thirds between the stay, leave and undecided camps. “With just three months to go until the referendum it is apparent that businesses feel they are simply not receiving the simple economic arguments for and against EU membership to help them make up their minds. Our snapshot of business is that the country remains deeply divided with the voting on a knife-edge, but that once business is given a coherent vision of the economic arguments for staying in the EU then the current crucial block of a third who are “undecided” tends to veer towards the stay camp, giving the stay vote a substantial lead,” Glyn Mummery, partner at FRP Advisory explained.

The study carried out just before the latest Budget revealed Boris Johnson is a business favourite, ahead of George Osborne as most likely next Prime Minister.

Asked pre-budget from a choice of four candidates who would most likely be the next prime minister and the influence of the Mayor of London was again telling with 48.4 per cent expecting Boris Johnson to take over from David Cameron, against 43.4 per cent expecting George Osborne, the current chancellor of the Exchequer to succeed.

Mummery added: “Notably Boris Johnson, Mayor of London and a member of the Brexit camp, seems right now to have equal influence with English regional business, according to our survey, to the role of the Prime Minister in deciding the business vote. While business looks as expected to the economic effects of EU membership for deciding its vote the current Chancellor of the Exchequer who sets economic policy comes second to Boris Johnson as their most likely next prime minister once David Cameron steps down.”

Investors and entrepreneurs also divided

Research from Seedrs suggests that the Brexit jury is still out for entrepreneurs and early stage investors.

While half of investors (51 per cent) and entrepreneurs (48 per cent) would vote to stay in the EU, 47 per cent of investors and 43 per cent of entrepreneurs would vote to leave. Nearly one in 10 entrepreneurs (said that they had no preference either way, compared to just 2 per cent of investors.

With his name behind the Britain Stronger in Europe campaign, Jeff Lynn, CEO of Seedrs, said: “As a business, Seedrs is in favour of Britain remaining in the European Union. We are a pan-European platform with London at our core, and we believe that we and our users stand to benefit from the open market that comes with Britain’s continued EU membership; in contrast, leaving the EU creates a number of very real risks for the British business community.”

Across every poll sampling the UK businesses, the divisive nature of the EU referendum rings out as a common thread.

As Lynn summarised, “It’s clear that this has become a debate lacking real information and that we are instead hearing soundbites from both sides. There is a need to present people with real information to help them make an informed decision in June.”