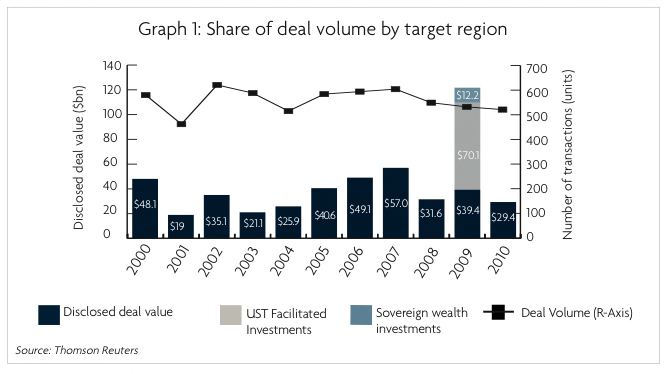

Research published by accountancy firm PricewaterhouseCoopers (PwC) found that the high number of disclosed deals by US Treasury and sovereign wealth funds totalled $82.4 billion of the $121.9 billion in deal value in 2009 (see graph 1 below).

However, there was reason to be optimistic as strong figures from Asia and Europe showed that the market is on the up.

Jason Wakelam, leader of PwC UK’s Automotive Transaction Services, said the big mover is Asia and highlights the rise from 23 per cent to 31 per cent in the share of global disclosed deal value as the finding to pay most attention to.

He explained, ‘Asia is strategically key, with China and India at the centre of that in terms of demand in those markets and localised production growing, not only from local manufacturers but also the western manufacturers moving to those territories in increasing numbers.’

The report found that during 2010 the automotive industry and its supply base saw a recovery of production volumes, which led financial buyers to rebalance their portfolios away from non-production related assets such as automotive retail.

‘One of the key drivers of the Asian increase is the fact that, in addition to them being the big growth market, you’ve got increasing demands for localisation of manufacture and supply of parts,’ Wakelam said. ‘And that is being driven through taxes and import duties.’

The automotive M&A market saw the return of private equity in 2010, with four IPOs completed in comparison to zero the previous year.

On a European level, the report finds that the IPO exit route is not as attractive an offer with the UK’s FTSE not showing significant interest in automotive IPOs.

‘From the private equity perspective one of the things that is worth noting is that it peaked in 2009, and therefore if you have seen a bit of a step back in 2010, they are still ahead from a volume perspective compared with 2006-2008,’ Wakelam explained.

There should be a lot of automotive M&A in Europe coming from Chinese and Indian investment in particular. That will be structured around how they can improve the quality of their product, such as safety electronics or engine transmissions.’