The number of companies choosing to pursue growth on the public markets has limited the amount of mergers and acquisitions (M&A) taking place.

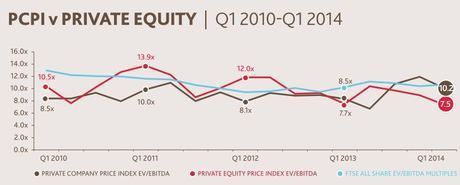

BDO Corporate Finance‘s PCPI/PEPI index, which tracks the relationship between enterprise value (EV) and EBITDA paid by trade and private equity buyers when purchasing UK companies, finds that a slow start to 2014 has occurred.

A 24 per cent dip in trade deals has been noted alongside a 12 per cent fall in private equity transactions, from 84 to 74. The rise in IPOs is a ‘positive sign’, the index suggests, but results ‘clearly show’ that the activity has taken deal flow from private company acquisitions.

The price of FTSE against the private equity and private company indices

Alongside the impact IPOs are having, BDO also says that the political stand-off in Ukraine is leading to investors deferring decisions in the short term.

Tim Clarke, partner at BDO, comments, ‘What we have witnessed is a great revival in the UK stock market, but along with the events in Eastern Europe, there has been a diversion of capital away from mergers and acquisitions.

‘We do expect this to rebound towards the end of this year, however, as institutional allocations for new IPOs has become saturated, and companies once again turn to M&A to complete their deals.’

On the positive sign for UK M&A, BDO’s index shows that software and IT services experienced a good period. The average EBITDA transaction multiple for IT has grown from a little below 7x to 8.75x currently, while software has experienced growth from 7.5x to 9.75x. It cites deals including Alternative Networks’ acquisition of Control Circle for a 20x EBITDA as evidence of the strength in the sector.

Recent research compiled by the Global Markets Intelligence research unit of S&P Capital IQ suggests that big-ticket M&A could see Britain achieve its busiest M&A period since 2007.