Investors funnelled more money into British start-ups and high-growth companies in the first half of 2017 than ever before. Mega-deals, like the £389 million investment into cloud computing software firm, Improbable, and £313 million in fashion tech platform Farfetch led the charge in H1 2017.

Are these deals setting a new benchmark for the UK, or are they too good to be true?

A new report, British Growth Stars, assesses the biggest deals made in the first half of 2017, and was compiled against the backdrop of continuing concerns over Brexit and its esoteric ramifications on currency rates, policy, and investment climate.

Global uncertainty also prevails, with the rollercoaster Trump presidency, and the unrelenting growth of American and Asian tech giants.

However, the British entrepreneurial ecosystem has never been healthier.

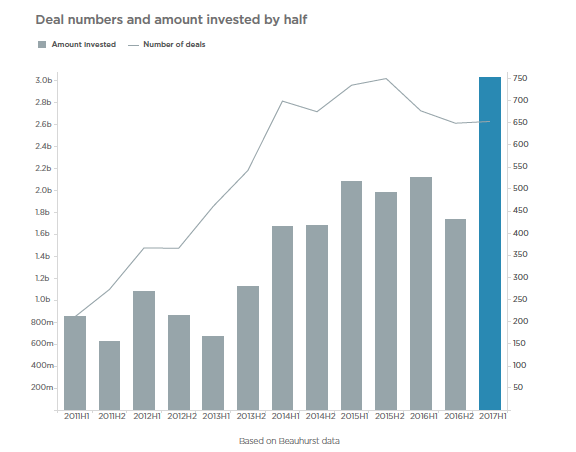

Dealflow data from the first half of the year shows that investment volumes have been skyrocketing compared to last year. UK-headquartered unlisted companies attracted a record £3.03 billion of equity investment during the first six months of 2017, up 74.7 per cent from the second half of 2016.

Interestingly, the deal numbers reveal a different story. The first half of 2017 saw 3.5 per cent fewer transactions than the same period last year. What this shows is that the UK is now seeing larger deals enter the pipeline, fuelling growth at a rate the start-up ecosystem has never seen before.

But the numbers could be skewed. In the first six months of 2017, the UK saw two of the biggest deals so far – cloud computing firm Improbable raking in £389 million from American firm, Softbank Capital, and fashion-tech marketplace Farfetch securing £313 million from China’s JD.com.

The UK’s record half for equity investment was largely because of fire-power from overseas investors.

This suggests that the number of deals involving investors headquartered outside the UK was up by 26.7 per cent in the first half of 2017, which experts suspect is a direct impact of the weakened pound over the past year.

It could also be symptomatic of the fact that early-to-mid-stage UK business now have a host of funding options, but for later-stage businesses, attracting investors to fund their Series D round and beyond is an uphill task.

Based on transaction data tracked by Beauhurst, a leading research platform specialising in high-growth companies, this report looks at the equity investment landscape, as well as the most promising companies in the UK, from seed to late stage in their growth.

Speaking to investors in the most active venture firms, the report dissects how the two largest deals to date came to be, and what the industry can expect for the rest of the year.

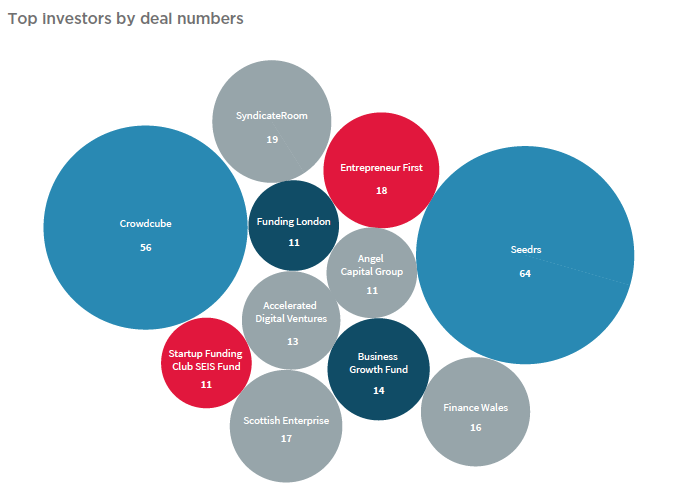

In the first half of 2017, the number of deals secured on crowdfunding platforms, rose by 2.6 per cent, even though transaction numbers slowed in the second half of the year. Looking at the equity crowdfunding sector, the report also zeroed-in on the most active platforms, speaking to those at the helm on the biggest trends in alternative finance.

The British Growth Stars is an independently reviewed, data-driven, editorially-led report that deep-dives into the UK’s fast-growth business landscape. This is the first edition of the report, which includes industry analysis, expert insight, interviews and profiles of top funders and unlisted UK-based start-ups that have raised funding in different stages of its growth. The report is sponsored by Barclays and supported by Beauhurst.