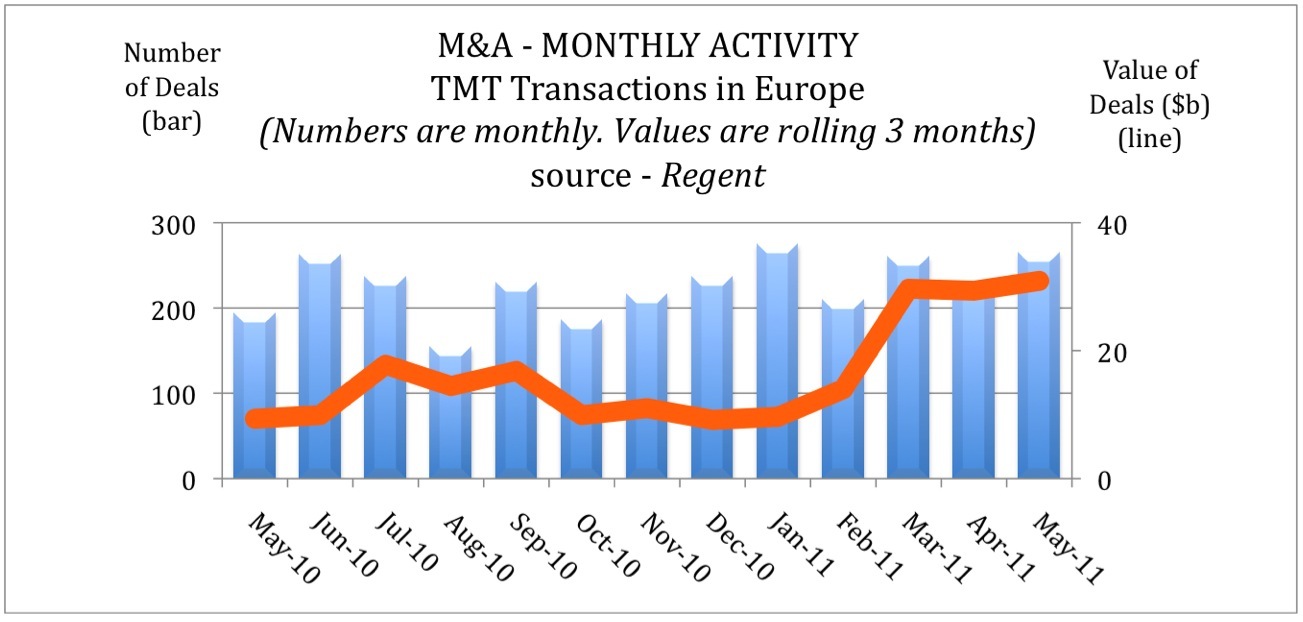

The volume of M&A deals recorded also rose, with the number of deals in May totalling 265, according to data compiled by Regent Partners, with deal values for May recorded at $26.7 million (see graph 1 below).

The deal values were boosted by the high-scale $8.5 billion acquisition of internet phone services Skype by computer giants Microsoft.

David Scurr, research director at Regent Partners, says the technology sector has been a way of providing cost savings.

He adds: ‘In a tight economic environment there has been some opportunities to make some savings by careful use of technology.

‘There has been a greater confidence in the technology sector, it’s stronger in the past year than it has been after the tech bubble of 1999/2000.’

Social media has also been in the spotlight during May, with the £40 million acquisition of London-based Tweetdeck by micro-blogging site Twitter announced. The deal was the biggest for Twitter in its five-year history.

The IPO market saw the listing of LinkedIn, with the doubling of its share price prompting fears that the IPO was undervalued.

Robin Johnson, partner at law firm Eversheds, says that the pricing of technology stocks is notoriously difficult because the value is based on future revenues and advertising spend and not historic or current performance.

Johnson explains: ‘Many commentators are predicting that the technology industry is heading for a bubble, which is likely to burst as it did in the early noughties.

‘Meanwhile others are saying that for every success there are many technology failures, which means that those successes are highly valued.’

Johnson believes that technology stocks are not for the ‘faint-hearted’ as they are a higher risk, but that the high levels of M&A activity in the sector indicates that it is on the up.

Compared to companies that went through the dot com burst Scurr believes that companies are now more resilient than they used to be.

Scurr adds: ‘They certainly have a sounder financial basis. Since the industry suffered badly, many of the big companies restructured themselves and have built up big cash balances.’

The result of this is that these companies are now seeing opportunities for new ideas and concepts coming out, Scurr hypothesises, with these companies able to go out and buy exciting new ventures instead of having to build them by themselves.

The findings also reveal a rise in price/earnings and price/sales ratios.

Scurr explains: ‘We see more realistic expectations from both sides, the buyers and the sellers are more realistic about valuations and that is more conducive to doing deals.’