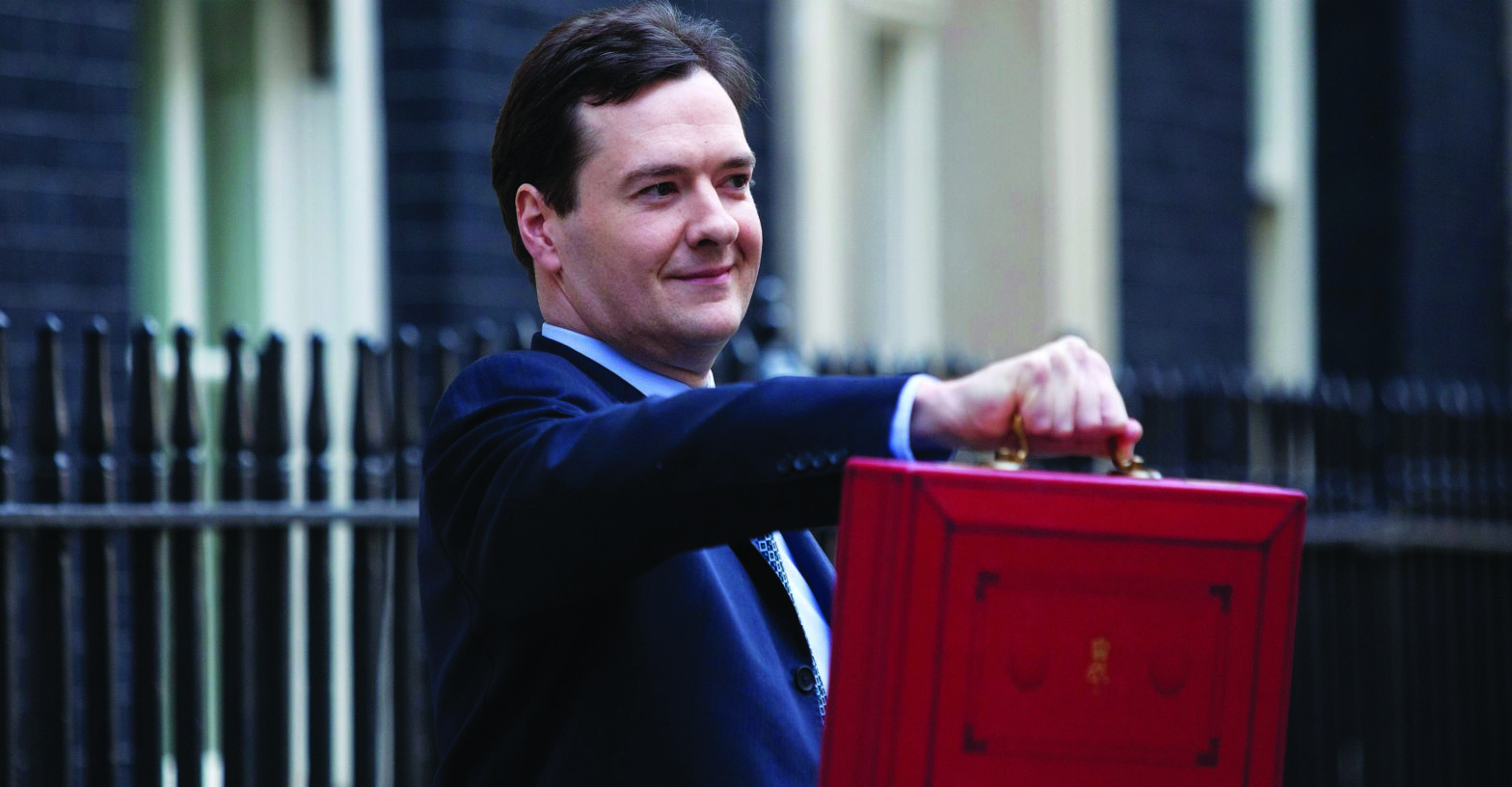

The headline rate of corporation tax will be further cut to 20 per cent from 2015, under plans outlined in George Osborne’s fourth Budget address.

The coalition government came to power in 2010 when corporation tax stood at 28 per cent. Successive Budgets have brought the figure down to the planned figure of 21 per cent.

However, the chancellor has said that the amount will be decreased by a further 1 per cent, taking it to 20 per cent. He declared that, ‘Britain is open for business.’

‘We set out to compete with the world on the headline rate of corporation tax,’ Osborne said during his address to parliament.

He added, ‘Today I want to send a message out that Britain is open for business. The 20 per cent rate is the lowest of any major economy in the world, that is a tax cut for jobs and growth.’

The cut to 20 per cent is the third in a row by Osborne, with the rate dropping from 28 per cent to 24 per cent in April, and from 24 per cent to 21 per cent in 2014.

More on the Budget 2013:

- Entrepreneurs’ wish list for George Osborne’s 2013 Budget Speech

- Growth market boost as stamp duty tax on AIM shares eliminated

- Investors in SEIS secure extension to capital gains tax relief

Richard Britton, CEO of CloudSense, comments, ‘The reduction in corporation tax is very welcome and will hopefully drive increased investment in equipment, skills and ultimately people – but lots of business are likely to use the extra money to offset increased costs.

‘At the same time the investment earmarked for traditional infrastructure projects could be better used upgrading our digital infrastructure, something that would drive growth and help form the basis of a 21st century economy’

James King, managing director of Find Invest Grow (FIG), a VC firm that invests in start-ups founded by students and recent graduates, says, ‘We knew that a decrease in corporation tax was on the agenda for the Budget and of course, it’s a positive step.

‘But there is room for the government to think more creatively about tax cuts/reliefs to increase liquidity, especially in start-ups. For example, unclaimed tax relief investors receive from the EIS and SEIS initiatives could be passed on to the start-up receiving investment.

‘Start-ups could offset investor’s relief against corporation tax over two years, as well as NIC or VAT. This approach would provide tax reliefs to those that really need it, while incentivising investors.’