Exit Strategies

Tag

Entrepreneurs’ Relief

Articles and analysis on the Entrepreneur’s Relief scheme, now known as Business Asset Disposal Relief (BADR), which offers significant tax benefits for entrepreneurs selling their business assets.

Exit Strategies

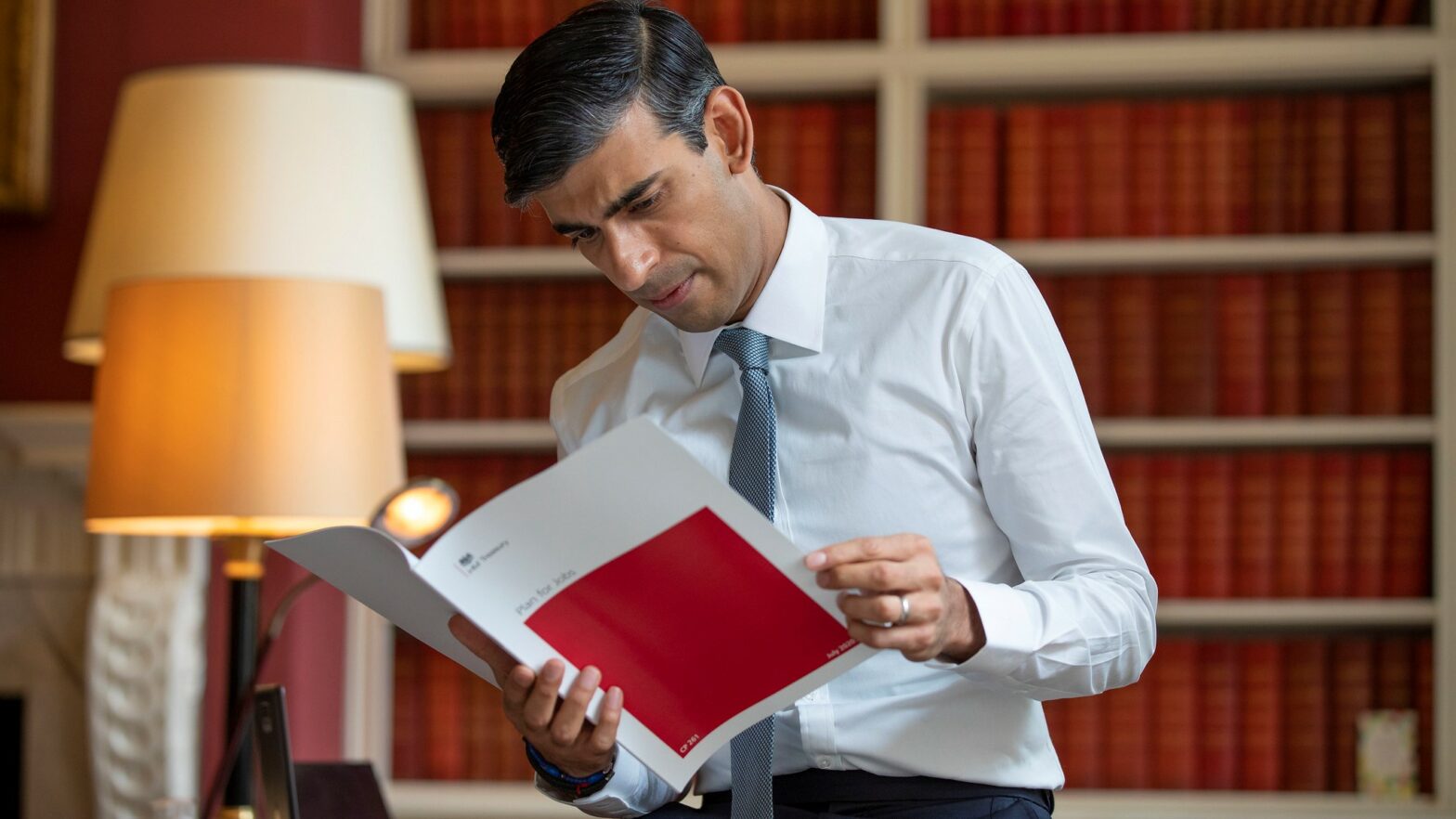

Don’t scrap entrepreneurs’ relief, argue small firms

Exit Strategies

Sajid Javid may guillotine, not scrap, Entrepreneurs’ Relief

Exit Strategies

Businesses push to be sold before Entrepreneurs’ Relief changes

Financial Management

Entrepreneurs’ relief in 2011 for all shapes and sizes

Financial Management

Maximising Entrepreneurs’ Relief when Exiting a Business

Financial Management

Tax breaks for investors in AIM

Financial Management

Company Share Schemes and Entrepreneurs’ Relief

Recommended Content

Partner content

Why upgrading your tech regularly will help your business grow

Accounting and Finance Software

Desktop vs cloud accounting: What to consider

Accounting and Finance Software