Chancellor Rishi Sunak says he wants to change the way pension funds operate, enabling them to invest more in tech start-ups.

Pension funds are hamstrung by regulation that limits them when it comes to investing in scale-up tech businesses.

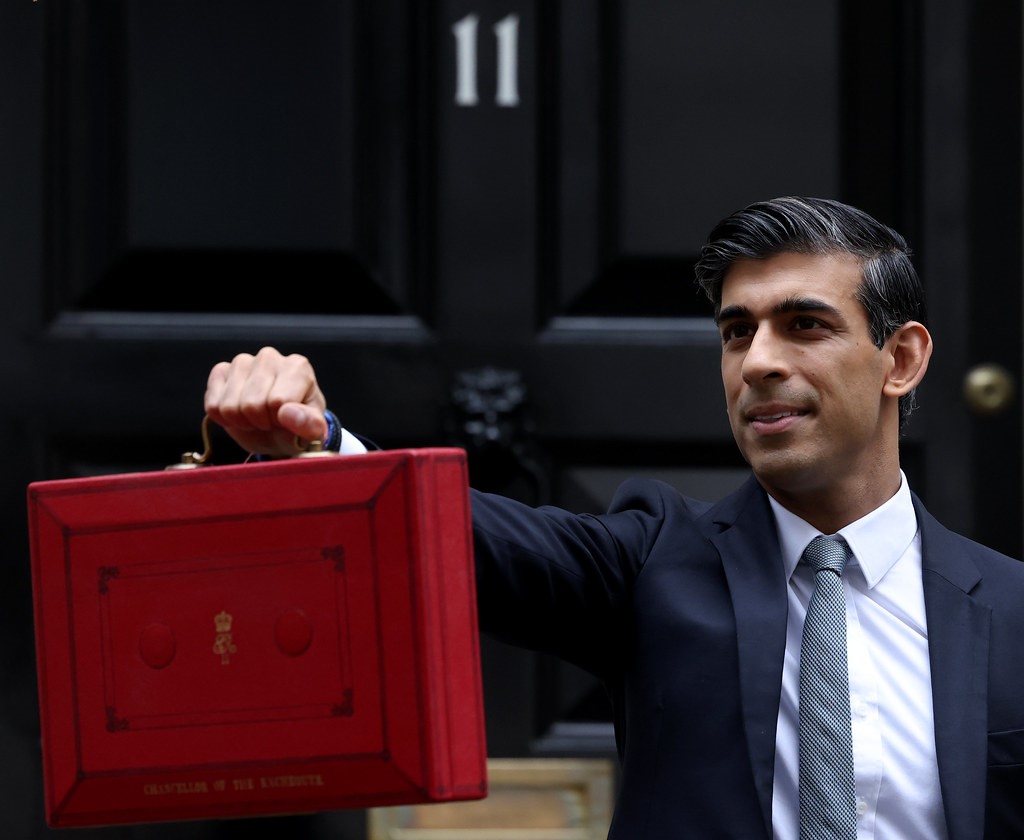

Announcing the Autumn Budget this afternoon in Parliament, Mr Sunak said the Treasury would consult on further changes to the regulatory charge cap for pensions schemes, unlocking institutional investment in growth businesses.

Previously, Mr Sunak told GrowthBusiness that it was up to everyone who pays into a pension to tell pension funds that they want some of their money invested in technology start-ups.

Relaxing of the regulatory charge cap for larger pensions schemes could unlock some of the £2.2tr currently off-limits to higher-risk, less liquid start-ups.

Direct contribution pension schemes will have £1tn under management by the end of the decade. If just 3 per cent more of that funding went to venture capital, it would amount to a £30bn increase in equity investment available for startups. Pension funds contribute 65 per cent of the capital in the US VC market, but just 12 per cent in the UK.

>See also: Government offers £1.4bn match funding for foreign tech investment

Sam Dumitriu, research director of The Entrepreneurs Network, said: “At the moment, there are major regulatory and cultural barriers preventing pension funds from investing in venture capital. The pension charge cap may protect savers, but it’s too rigid and incompatible with VC fee structures. Modest reforms, such as spreading the fee cap over a number of years, and relaxing valuation regulations on illiquid assets, could unlock massive investments in innovative tech businesses.”

Mr Sunak also confirmed that the UK’s target for spending £22bn a year on research and development would be delayed by two years until 2026-27. Public sector investment in R&D would rise to 0.7 to 1.1 per cent by the end of Parliament.

Separately, the Chancellor also expanded R&D tax credits to help encourage investment in cloud computing and data costs. He added he will look at ensuring investment from the tax break is spent in the UK rather than overseas.

Moray Wright, CEO of venture capital firm Parkwalk, added: “With the combined force of opening up pension fund investment into the innovative UK businesses of the future and a continued commitment to R&D spending, the UK is in a strong position to ‘level up’ and retain its crown as a “science superpower”. Both these initiatives compliment each other as greater support for R&D investment combined with a larger investment pool from pensions funds, greater support when they are ready to scale.”

Further reading

British start-ups raise £20bn so far this year, setting new record