The laws of physics state that what goes up must come down, and the M&A market of 2011 has proved this once again.

The modest resurgence in confidence that marked the latter half of 2010 carried through into 2011, with the UK’s M&A market showing signs of increasing health.

However, a parade of disappointing economic data both from home and overseas had a chilling effect, with the escalation of the sovereign debt crisis in Europe leading many dealmakers to conclude that now might not be the time to be contemplating acquisitions.

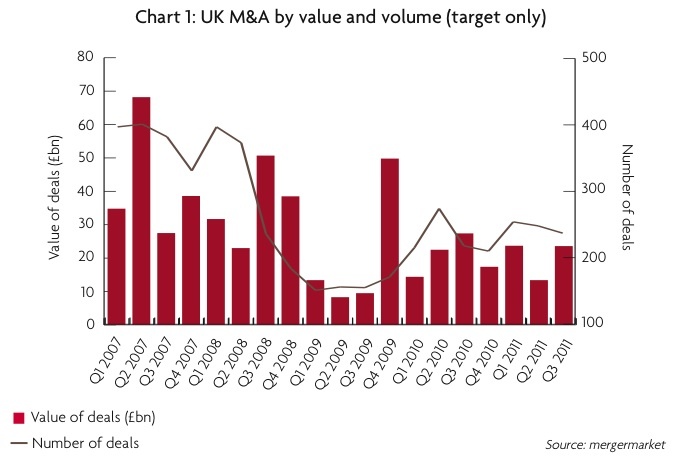

Hopes of a strong bounceback may have been quashed, but 2011 looks set to maintain roughly the same total transaction value as 2010 and 2009. Each of those years saw deals worth £80 billion announced in the UK, while the first three quarters of this year have witnessed £60.7 billion of transactions, according to research firm Mergermarket.

The number of deals announced from January to September 2011 was 739, slightly higher than the figure for the same period of the previous year, which was 707.

Buy-out Boost

In the mid-market, a realignment of vendor and bidder expectations could lead to a healthy flow of deals in 2012, believes Jonathan Boyers, head of corporate finance for KPMG in the North of England. He sees private equity buyers in particular as ‘very enthusiastic to put money out of the door’.

‘These days dealmakers will struggle to get a good debt package for a £200 million transaction, but if they need £20 million to £30 million there are several banks which are lending in the leverage market – not aggressively, but they are putting packages together which can be a cornerstone of those private equity deals,’ says Boyers.

Following a prolonged period of hibernation for buy-out firms, when they seemed content to sit on funds raised and wait for the storm to pass, the industry has seen a revival during 2011. Research from Lyceum Capital and Cass Business School, which tracks private equity deals of between £10 million and £100 million in the UK, shows that 63 transactions were completed in the first three quarters of the year, compared to 50 and 25 over the same periods in 2010 and 2009 respectively.

Mid-market firm Gresham Private Equity has had what managing partner Paul Marson-Smith describes as a ‘phenomenal’ year, with two new investments and 12 bolton deals completed, and one more new investment simmering.

In July Gresham backed the secondary buy-out of Walker Technical Resources, a business which provides repairs to pipe work for the oil and gas industry. Marson-Smith concedes that Gresham exists at the rather ‘unglamorous’ end of the private equity spectrum, but that through backing small to medium sized companies it is enabling them to achieve their growth strategies.

Legal Change

Private equity was the main target of legislative change which came into force during September. The revised Takeover Code put in place a number of new measures aimed at giving power back to the target company, a move which some industry figures worry will deter deal activity.

However, Marson-Smith declares that private equity remains a ‘force for good’ in the mid-market, with SMEs in need of both expertise and capital. He points to the fact that Gresham’s portfolio companies saw an aggregate sales increase of 30 per cent in 2011, adding that the firm’s emphasis on maintaining a strong regional presence in the UK has been ‘critical’ to its success.

‘We started to regionalise our business 15 years ago with the aim of getting close to our market,’ he explains. ‘It is about developing our relationships with entrepreneurs and businessmen right across the regions.’

It’s notable that the majority of Gresham’s deals in 2011 have been bolt-ons to existing portfolio companies. With banks still reluctant to take on risk, private equity’s role in providing the firepower for such deals continues to be critical.

Market research company SPA Future Thinking has closed two deals of this type in 2011, aided by a facility from its private equity backer Next Wave Partners which allows the company to draw down cash as required to make acquisitions.

‘Next Wave facilitates our acquisitions and allows us to cherry pick,’ says chief executive Jon Priest of the purchases of Munro Market Research and Essential Research. ‘Without their support, we would be limited to purchasing companies that, although affordable, could also represent a greater risk.’

Rescue Deals>

The confidence to close deals has been a commodity in short supply during the past year. Research from Mergermarket shows that only 20 per cent of dealmakers in the UK are ‘very confident’ about the outlook for M&A over the next year, while 4 per cent are ‘extremely confident’.

That compares unfavourably with Germany where 48 per cent of dealmakers are ‘very confident’ and 16 per cent ‘extremely confident’.

Echoing this subdued mood, third-quarter insolvency statistics reveal that there has been a year-on-year increase of 6.5 per cent in company insolvencies, with 4,242 recorded.

However, the struggles encountered by businesses have presented a number of opportunities for acquisitive companies to purchase distressed businesses with the intention of leading a turnaround.

AIM-listed electronics specialist Solid State has made a habit out of seeking out ailing businesses; a technique which chief executive officer Gary Marsh says provides good value for money.

He explains: ‘As long as you have a plan of how to turn them around, which we always do, these deals can be very beneficial. Buying [businesses] that way provides significant savings compared to acquiring them in more prosperous times.’

In October Solid State rescued ruggedized computer and hand-held devices business, Blazepoint, out of administration for £200,000. Marsh believes that despite struggling in the downturn, Blazepoint represents an attractive investment and one that will bring ‘significant profitability’ to Solid State.

Based on its track record, Marsh says that Solid State now has the in-house team necessary to identify ailing companies and devise an integration plan which will result in a quick turnaround and return to good fortunes. ‘There are a number of competitors at the £3 million to £6 million turnover level, of which some are experiencing more difficulty than others,’ he says.

As Solid State has been acquiring on the cheap, it has been able to fund deals out of its existing resources. However if a larger deal presented itself Marsh believes that its stock market quote and its experience of integrating businesses would put the company in a good position to raise fresh funds.

Banks Bypassed

The need to raise funds in recent times has led to many businesses looking away from traditional bank debt to alternative sources of capital which will allow them to pursue their M&A plans.

Asset-based finance has seen solid growth during 2011, with the aggregate turnover of all companies using it increasing 14 per cent to £115 billion for the six months ending June 2011, according to trade body ABFA.

Export and import factoring have seen particularly strong growth. Kate Sharpe, ABFA’s chief executive, says, ‘This is the first time we have turned client numbers round since the recession.

As well as that, advances are up 12 per cent [to £15.8 billion], and I would forecast similar findings for the rest of the year and leading into 2012.’

Clearly not afraid of taking a controversial stance, Sharpe believes banks are right to be adopting their current conservative approach and leaving more uncertain debt packages to asset-based lenders.

Aiming High

Another source of deal financing which some companies are still managing to access, albeit with some difficulty, is the stock market.

Total funds raised on AIM by new issues between January and October amounted to £532 million, according to data from Business XL, compared to £866 million in the same period of 2010. Secondary fundraisings fetched in a much higher figure of £3.1 billion, compared with £3.4 billion last year.

Despite these discouraging declines in funds raised, close watchers of the junior market also noted that August was the first month since 2007 when more companies joined the market than delisted.

One company which has had a productive year on AIM is Allocate Software. It has completed two acquisitions taking its deal count to six whilst under the tenure of chief executive officer Ian Bowles.

On the back of its 2011 purchases of Zircadian and RosterOn, which were financed out of the £8 million it raised in 2009, Allocate is now moving towards its target of deriving 65 per cent of its revenues from its overseas operations. The RosterOn deal alone increased Allocate’s number of Australian clients from three to 78.

Despite Allocate’s success at raising funds on AIM, Bowles comments: ‘The capital markets are a difficult place to be. There is lots of money looking for a home but investors are risk-averse.

‘There are decent companies out there that perhaps don’t have the same percentage growth figures and don’t feel that the capital markets are right for them.’

Tech Boom

In contrast with the wider M&A market, the technology sector has performed strongly during 2011, with figures from Ernst & Young finding that the value of all corporate and private equity deals increased to £36.3 billion during the third quarter of 2011, an uplift of 22 per cent year-on-year.

That figure was bolstered by an upsurge in the volume of business intelligence and analytics deals that were completed.

For Allocate Software, its cross border deals have been about adding new services to its existing offerings and acquiring customers in new regions. Similarly, online take-away website Justeat.com has pursued an acquisition strategy designed to grow its global footprint.

Deals have been completed in countries including India, Italy, Brazil and Switzerland: a strategy described by CEO Klaus Nyengaard as getting a ‘leading position in terms of geography’.

He adds: ‘[Cross border] deals take a lot of time to make happen – the process is quite complicated because you are working in a different environment.’

To minimise the risk of doing the wrong deal, Nyengaard says all due diligence is done in-house, rather than outsourced. ‘We don’t pay premium prices, so some of the people we have discussions with take a while to come to an agreement. If a proposal gets accepted fast then you know you’ve paid too much.’

Limited Horizons

Despite the relative buoyancy of the technology sector, some business leaders feel that the UK is still at a disadvantage when it comes to dealmaking. Frank Joshi was part of the team that secured the sale of IT business changeBASE to US bidder Quest in a £30 million transaction.

While the sale marked a successful turnaround for changeBASE, which had been hit hard by the failures of Microsoft’s Vista operating system, it was still something of a disappointment for Joshi, who had spent four years as the company’s chairman.

On the back of its initial problems, changeBASE had looked to raise cash in the UK to expand its services, which centre around software that assists migration from old to new operating systems, but found no interest at home.

Joshi explains: ‘No one was interested in any form. We even talked to Microsoft as we could have added tremendous value to their proposition.

‘The three main directors ended up having to take out bank overdraft facilities – it was very hard to get cash even from the banks.’

The sale resulted from changeBASE attending a trade show, soon after which the company gathered a number of interested venture capital firms and software businesses, ‘but it was all American interest,’ Joshi reveals.

Transatlantic Shift

For British businesses to be able to grow and become global players a different approach to supporting these companies is required, says Joshi.

‘It is all about attitude, as in the US the investor market works with venture capitalists and banks making investments together, when quite often one will introduce the other to the target.

‘The frustration for me, as an entrepreneur running my own business and as an angel investor, is that people have to do it the hard way in this country.

‘That ultimately means that they build really good businesses which generate cash and profits rather than the US way which is to chuck a load of money at it, build up the hype and hope the revenues will follow,’ he adds.

Joshi says that the UK needs another 3i type model, which will provide finance for businesses in the middle market and not force them to sell out to the US.

He believes that Britain is still one of the most innovative places on the planet but that we have that ‘classic’ apologetic approach which prevents us making the most of it. It’s a characteristic that will have to change in this do-or-die environment.