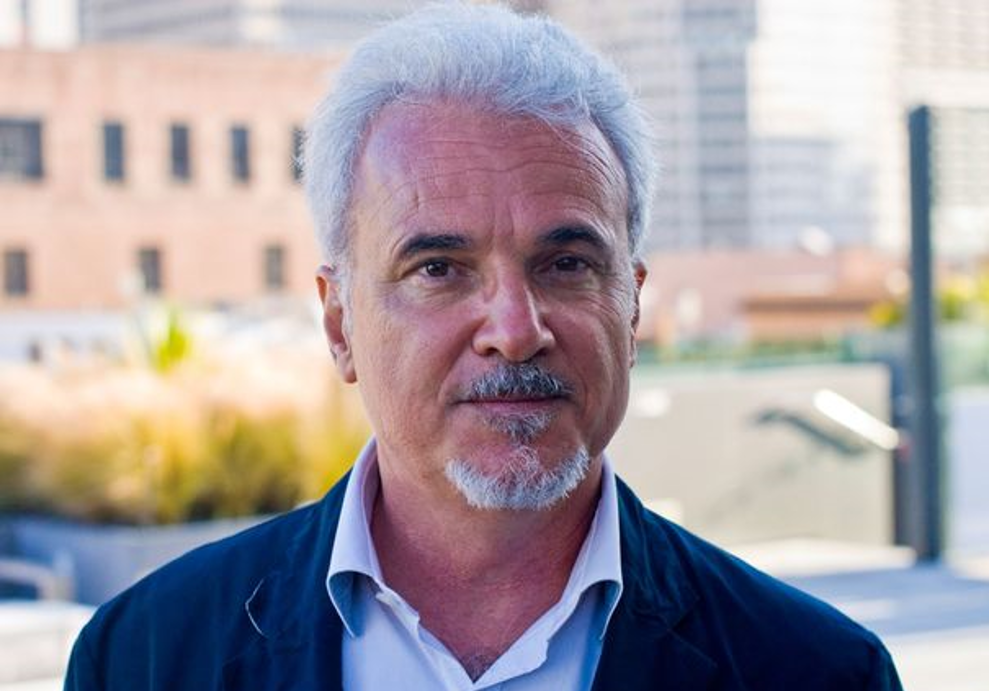

27 years ago, Jean-Michel Cambot founded the first French start-up to get listed on NASDAQ. It was a transatlantic success story like none other. His tech innovation, Business Objects, looked at data-based decision-making long before business intelligence was a term. In 2007, SAP acquired it, and Cambot became a national treasure in France. In 2011, he started up again.

Speaking to GrowthBusiness at Web Summit 2017 as part of the La French Tech delegation, Cambot shares his start-up journey at the helm of Tellmeplus, a business focused on what he calls ‘predictive objects’, using embedded artificial intelligence.

This new class of decision-making tools lies at the nexus of predictive analytics and smart Internet of Things. In 2011, this technology was unheard of, which posed a different set of challenges to Cambot.

Change in good

“My idea for Tellmeplus was very different in 2011 than what it is today. I was building an application that used augmented reality to capture things around users, and to learn their behaviour and tastes automatically with artificial intelligence. It was to make sure we deliver the best opportunities available to each customer and had a marketing purpose. What we’re doing today is completely different. Some things are the same; it’s about artificial intelligence, as well as understanding and predicting behaviour; but we’re doing that for different industries like aviation and manufacturing,” he says.

For example, Tellmeplus is currently working with an aircraft company to predict the non-conformity of work orders in the assembly line. The goal is to maximise efficiency. “This is very different from our 2011 model. I had to switch (the business model) three times, so Tellmeplus has gone from a marketing tool to a fintech tool, before I found the best choice, which is what we’re doing today.”

Cambot stresses that pivoting should be second-nature to entrepreneurs. “To be able to change like that, you need to accept when someone explains why your business model may not work. It’s not easy, but it’s important to be open to criticism.”

The first business model was just not possible, he explains. In theory, a marketing tool that uses augmented reality and artificial intelligence to offer users access to the best deals near them is genius. But it’s impractical at best, says Cambot. You need to have publishers on board to generate content, but they won’t come on board unless you already have a lot of users signed up. However, without publishers, you can’t attract users. It’s a vicious cycle that could stunt business growth. “When somebody explains this to you, and it’s usually a VC, it’s important to listen.

“VCs are generally straight to the point. If they tell you something isn’t going to work, they usually know what they’re talking about. You should say ‘ok, I need to change my idea and do something else’. It’ll pay off.”

Cambot coined a phrase from Jeff Bezos to summarise his thoughts on pivoting. “Be strong on vision, but flexible on details. This is the real secret sauce. You need a vision, which shouldn’t change from the beginning. How you get there can and should change along the way.”

Educate the market

Tellmeplus was always ahead of its time. The concept of predictive objects is still new, but when he was in the US two years ago at a Business France trade mission, he was one of the only people talking about smart IoT. “People were looking at me like I was E.T. We were working with (French train line SNCF), putting some intelligence into drones to predict when and where trees may fall on to tracks and so on. These drones share the imaging back, while prescribing what we should do in that case. That’s an example of predictive objects and what they can do. When I told the Americans about it, they thought it was fantastic, but also pure fantasy,” he says.

Know your strengths

The European venture capital scene is brave, bold, and booming, but many VCs hold strong reservations when investing in start-ups. In Cambot’s case, his track record was a huge asset, but even so, he realised that raising capital pre-revenue, with practically no customers would be an uphill battle. “I had to make some decisions which was not easy. I was the sole founder and CEO, but last year, I realised that to grow the business, I’d need to make some changes. Firstly, I needed to raise some money because the business relies on a lot of R&D, which means a lot of work needs to be done before we can make any money,” he says.

“In Europe, it’s very difficult to raise money when you don’t have customers or revenue. I raised €4.2 million for Tellmeplus, but it was a challenge. For that, I needed to highlight my background as an entrepreneur and I also chose a business partner with a lot of business success behind him; Benoit Gourdon. I asked him to be my CEO.”

Gourdon, like Cambot, has decades of experience in entrepreneurship and technology. He founded a marketing software vendor, Neoplane, which was acquired by Adobe in 2013. In that role, and his subsequent role at Adobe, Gourdon managed teams of hundreds.

“Benoit has the experience of managing an international company; experience that I don’t believe I have. I was always an inventor. Managing people, especially as we grow, isn’t my area of interest,” Cambot adds. “I like to create, I like to build on my vision. My role now in the company is strategic. Making sure the business is growing in the right way, speaking at events, giving masterclasses and keynotes. That’s my passion.”

On the razor’s edge

Being a French company is now is a huge advantage, according to Cambot. When he started up nearly three decades ago, the world was a very different place for entrepreneurs. For tech start-ups looking to expand, having that French footing can be a blessing. “Now if French start-ups entered the US market, the R&D will stay in France because today everyone, including Facebook, Microsoft (and other international tech companies), have their artificial intelligence based in France. They recognise that the French scientific world is strong.”

“The world has changed, but entrepreneurship has not. You’re an entrepreneur in your DNA. I think it’s easier now to start up, at least in France. It’s very fashionable, and is widely encouraged. Of course, it’s not very easy to be successful, but it’s now seen as a good thing to be an entrepreneur. It was certainly not the case 25 years ago,” he says.

“My children are starting up, too. They can find an incubator and very quickly can challenge their ideas against reality to see if it could work as a business. It’s much easier today.”

Success as an entrepreneur isn’t always guaranteed, he adds. “You must be able to switch very fast and challenge your own ideas to make something completely different if necessary. Be open minded to listen to the advice of other people. “Even with a growth mindset, it can be hard to stay grounded as a start-up entrepreneur. “You’re always on the razor’s edge; sur le fil du rasoir. One misstep and you’re dead; the company’s finished. If you fall on the right side, you’re a billion-dollar business. I hope after the next funding, we’ll finally move to the right side of that edge.”