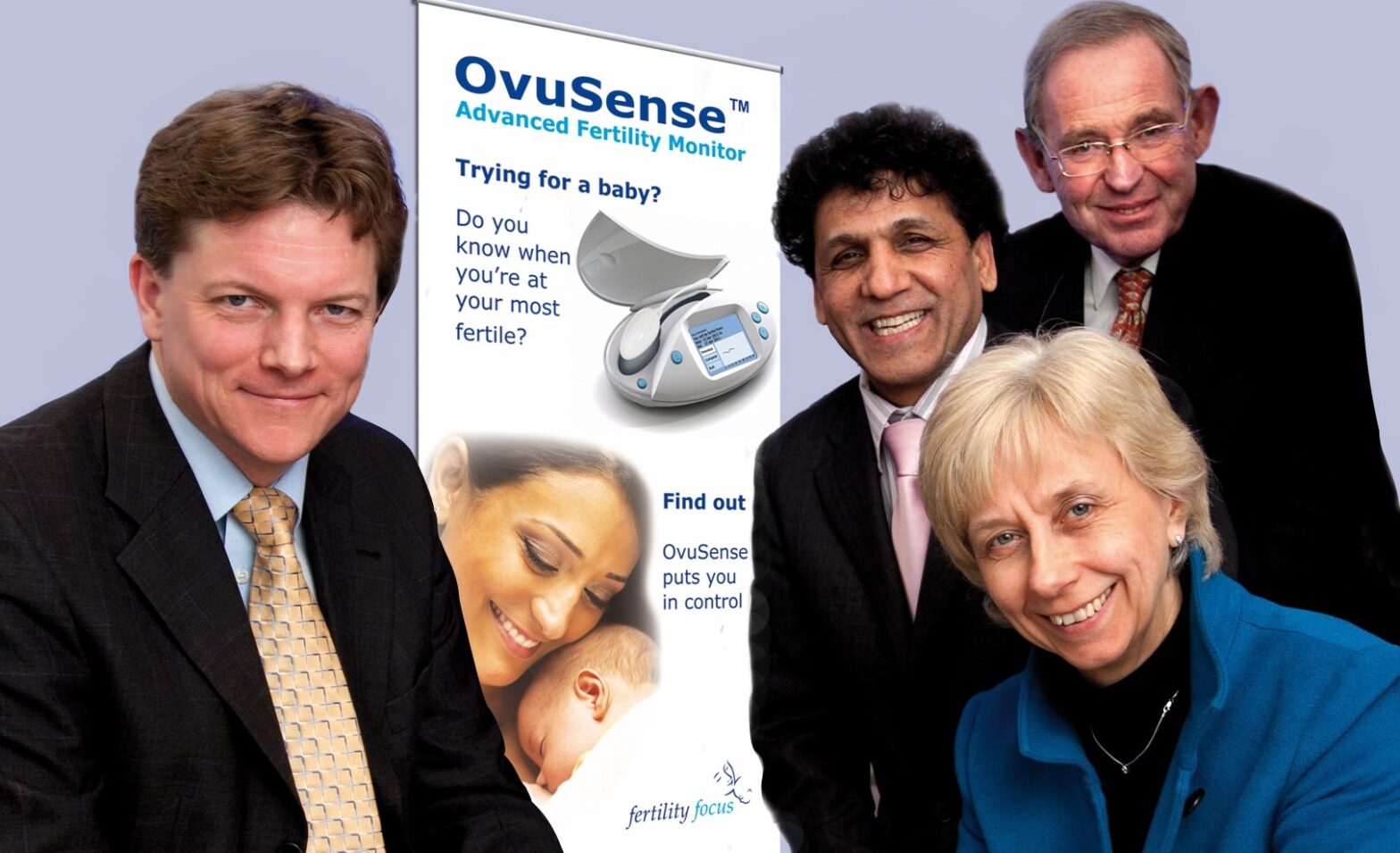

Fertility diagnosis and treatment business Fertility Focus has followed on from the trial of its lead product by attracting an undisclosed seven-figure venture investment.

The £50 million Angel CoFund, which has been created using a grant from the Regional Growth Fund, has invested alongside Midven’s Exceed Fund.

Fertility Focus’ OvuSense product is a fertility monitor which identifies and predicts a woman’s fertile period in the hope that it will allow couple’s to conceive. The business also says that the treatment is able to detect the presence of ovulation.

Further funding will come from Norgenix, the firm’s strategic partner and US distributor. Fertility Focus is currently securing approval for the product to be used in the United States, with the new investment capital set to be used to facilitate the roll-out of products around the world.

Robert Milnes, CEO of Fertility Focus, comments, ‘This funding opens a new chapter for the company and its products.

‘It will expand our team in direct territories and greatly widen the marketing support we can provide throughout our sales channels.’

Midven’s participation in the round marks the second time it has backed Fertility Focus. In March 2011 the investment firm was the lead backer in a consortium which helped Fertility Focus complete the development of OvuSense and get regulatory approvals for the European market. The deal was worth £775,000.

More on deals by Midven’s Exceed Fund:

- Confluence to expand with Midven support

- pr2go secures Midven capital

- Birmingham video firm nets cash

Fertility Focus was formed in 2005 to license intellectual property for the Fertility Monitor from Bristol University and has, since then, developed two products that aim to diagnose and treat infertility, with its FertiloScope product sitting alongside OvuSense in its portfolio.

Julie Newman, executive director at Midven, adds, ‘This is an exciting time for Fertility Focus, which was formed in 2005 with a mission to halve the time and cost to pregnancy for infertile couples.

‘The company has developed two unique and innovative products and the prospects – in the US and across the world – are very considerable indeed.’

Midven’s £18.4 million Exceed Fund was established in December 2009 to invest in high growth businesses in the West Midlands. It became operational in March 2010 when LDC became an investor in the Fund.