I’ve seen a lot of start-up pitches. I’ve started businesses. I’ve advised a lot of investors. I’m an investor myself. But something is starting to really trouble me. Are we going too far in encouraging our young talent to follow their dreams and launch a start-up, which in the end might not actually rock the world?

First there were the pioneers in the late 90s and early 00s (including me!) ; the web was a ‘new media’ and full of hopeful, expectant business models, not one of them mobile and all based on hilariously slow net speed (256k dial up anyone?). Company valuations were based on things like harvested email addresses or credit card numbers. Crazy, but at least these were tangible metrics based on actual transactions and historic performance.

Companies quickly won and lost, the likes of eBay, Google, Amazon were spawned and accelerated. Others flew then fell but that was OK; the boring old guard of slow growth and low risk was under attack. However investors were not so ubiquitous. Interest rates were high (above 7 per cent) and therefore high-risk, high-yield could be balanced with normal safe investments. Company founders were in their late twenties, thirties and forties. They’d seen a few things in their lives and took a risk for a couple of years and if it didn’t work they could easily slide back into their ‘old’ corporate jobs.

Fast forward 20 years to 2017. Interest rates are zero, or close to it. There are no ‘safe investments’. All of the old guard have had to digitally transform, or face disruptive annihilation. It’s not just smart / high risk capital going into low cost / high risk start-ups these days, its ALL the money in a non-stop frenzied financial FOMO.

https://growthbusiness.co.uk/lessons-young-angel-investor-adrian-clarke-2551732/

The vast proportion of start-up company founders I speak to are aged 22 to 30, with a year or two at most inside a ‘real’ company which actually functions and makes money; however just as many have only ever worked inside loss-making start-ups since leaving school or college. They don’t talk strategy, P&L or cashflow, they talk ‘launching’, ‘scaling’ and ‘funding’. Every single one of them is absolutely, totally convinced that they have discovered the one niche in their vertical which will propel them to a rich, interesting and lucrative life.

I’m also fascinated to read this week in a period just before multiple events of potential political instability that numerous VC’s are finding fresh finance and rearming their financial arsenal and getting ready to carpet bomb their respective ecosystems with a fresh layer of ‘growth capital’.

Then finally, a great friend of mine recently told me that his son; following years and years of private education and two years of Russell group education (I reckon about £150,000 worth) is dropping out of his University course to join a start-up and will I mentor him?

I mean, WTAF?

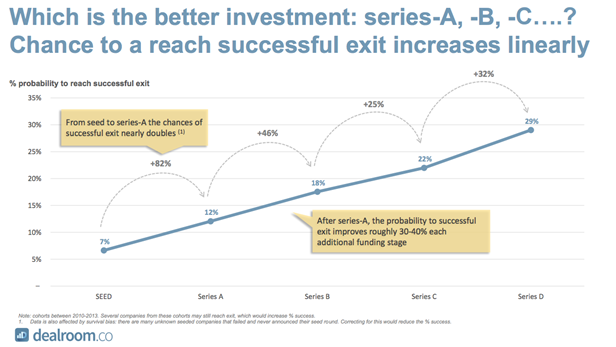

So how does this money-go-round keep going round? I think this chart from Deal Room certainly explains what keeps the investors in the game:

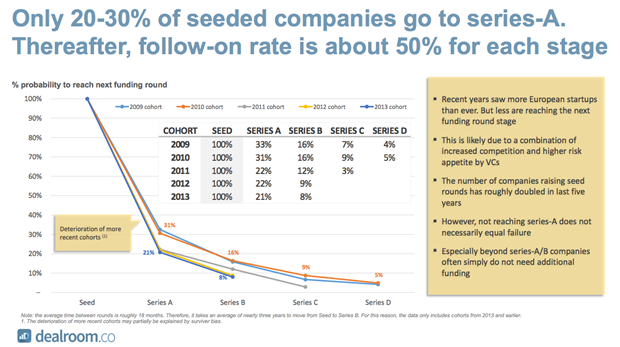

But then compare it with this one:

Yep. Only a quarter of seeded businesses get to the next level of funding. This chart doesn’t even touch on the pre-seed equation. I reckon personally I invest in 1 in 250 companies I see. That might be generous or not compared to my peers. Of course the crowdfunding platforms so help, but is this smart or dumb money? I’d love to know the ratio of these types of funded businesses on this chart above.

Then there is the exit. Yes the part when all the tears, sweat and money is repaid. So if you see what I now do for a living, then look at our owners, check their balance sheet and work out what we have in the bank. Also as a listed company there is access to plenty of investment capital should we need it. We are interested in growth and some of that may or may not come through acquisitions. I’ve almost given up looking at businesses which are all miraculously valued at $10m-$20m regardless of age, vertical, income or profit multiples.

Sales revenues are vanity, Profit is sanity and cashflow is reality. All I see right now in start-up or early stage acquisition opportunities is vanity and even there a lot of growth is paid for with hugely negative ROI on sales and marketing spend, mainly as a result of overspent CAC and crazy optimistic LTV numbers. So instead we look around and build all the good models we see internally using a mix of out-of-London talent and high quality, work-their-asses-off offshore capability. Which is currently working out at about 5 per cent of the price of buying it in (and we don’t need to worry about the core team buggering off to a beach with their winnings, post-exit!).

London (and most other European capital cities) right now is an explosion of creativity. It is awash with seed and growth capital. Every corner or town has a start-up hub, office or co-working space. Young people are emerging from higher education, or crossing oceans in their early twenties, full of hope, energy, passion but critically lacking in experience and most importantly any kind of negotiating firepower. So they do bad funding deals and also buy in overpriced talent resources, mostly as a toxic mix of inexperience and time-pressure to ‘fail fast and move forward’. Result – most of them will hit dry-hole day (as we called it in the 90s) early than expected and run round for months or even years chasing fresh funding instead of actually growing their business.

And sadly, tragically for this bright young emergent talent, 80 per cent of them won’t make it.

But does it matter? This is the funder model right? Spread your bets and pay for the hundred losers with the one winner? It’s a good system for making money. Back the founders based on their spirit, guide them past the pitfalls and hopefully raise money each stage at a higher ‘valuation’. Even if it’s a down-round, don’t worry we can turnaround/pivot/de-merge/uncouple etc etc at a lower price but pick up the pieces later. Yes the banker never loses.

But what about the founders? The kids with the stars in their eyes? Well, they give it a shot, and if things don’t work out they are young enough to bounce right back with long fulfilling careers or second/third/fourth shots at the target till they get it right. Nothing to worry or care too much about right?

Trouble is these guys and girls are almost unemployable once they come off the start-up battlefield. They’ve seen too much, hoped too far, eating (free food and drink all day every day, but don’t you go outside or home and live any kind of fulfilling personal life!) at the highest table with the millionaires, billionaires and their mega-lifestyles and the rest of the glitterati. Try bringing a 27 year old ex-start-up founder (who didn’t get his series A / fell out with his co-founders / got fired for lack of experience) with three years of slowly losing everything, including his/her mental and physical health, into an operational account manager, marketing or sales role and then talking about 5 year career visions. You’ll get a manic screech or a punch in the mouth, most likely.

I don’t know the answer to this; it’s an open question. What can we do to support today’s and tomorrow’s brilliant talent without chucking them into the whirlpool and seeing if they can swim out. Of course the upside if things work out is nice fast growing companies who attract inward investment and provide employment (plus it keeps people out of the unemployment data) but the downside is debt, depression and in some cases even death.

Investors are in it for the returns, nothing more, nothing less. As the saying goes: Money doesn’t smell, have nerves or feelings.

But (young) humans do.

Richard Dennys is the CEO of Webgains.